Rollover Form - Quest Ira

Download a blank fillable Rollover Form - Quest Ira in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Rollover Form - Quest Ira with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

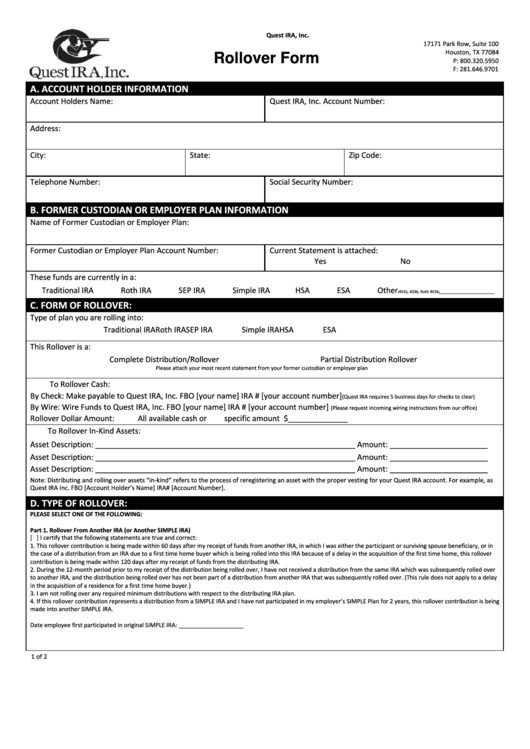

Quest IRA, Inc.

17171 Park Row, Suite 100

Houston, TX 77084

Rollover Form

P: 800.320.5950

F: 281.646.9701

A. ACCOUNT HOLDER INFORMATION

Account Holders Name:

Quest IRA, Inc. Account Number:

Address:

City:

State:

Zip Code:

Telephone Number:

Social Security Number:

B. FORMER CUSTODIAN OR EMPLOYER PLAN INFORMATION

Name of Former Custodian or Employer Plan:

Former Custodian or Employer Plan Account Number:

Current Statement is attached:

Yes

No

These funds are currently in a:

Traditional IRA

Roth IRA

SEP IRA

Simple IRA

HSA

ESA

Other

401k, 403b, Roth 401k

_________________________

(

)

C. FORM OF ROLLOVER:

Type of plan you are rolling into:

Traditional IRA

Roth IRA

SEP IRA

Simple IRA

HSA

ESA

This Rollover is a:

Complete Distribution/Rollover

Partial Distribution Rollover

Please attach your most recent statement from your former custodian or employer plan

To Rollover Cash:

By Check: Make payable to Quest IRA, Inc. FBO [your name] IRA # [your account number]

(Quest IRA requires 5 business days for checks to clear)

By Wire: Wire Funds to Quest IRA, Inc. FBO [your name] IRA # [your account number]

(Please request incoming wiring instructions from our office)

Rollover Dollar Amount:

All available cash or

specific amount $______________

To Rollover In-Kind Assets:

Asset Description: _____________________________________________________________ Amount: _______________________

Asset Description: _____________________________________________________________ Amount: _______________________

Asset Description: _____________________________________________________________ Amount: _______________________

Note: Distributing and rolling over assets “in-kind” refers to the process of reregistering an asset with the proper vesting for your Quest IRA account. For example, as

Quest IRA Inc. FBO [Account Holder’s Name] IRA# [Account Number].

D. TYPE OF ROLLOVER:

PLEASE SELECT ONE OF THE FOLLOWING:

Part 1. Rollover From Another IRA (or Another SIMPLE IRA)

[ ] I certify that the following statements are true and correct:

1. This rollover contribution is being made within 60 days after my receipt of funds from another IRA, in which I was either the participant or surviving spouse beneficiary, or in

the case of a distribution from an IRA due to a first time home buyer which is being rolled into this IRA because of a delay in the acquisition of the first time home, this rollover

contribution is being made within 120 days after my receipt of funds from the distributing IRA.

2. During the 12-month period prior to my receipt of the distribution being rolled over, I have not received a distribution from the same IRA which was subsequently rolled over

to another IRA, and the distribution being rolled over has not been part of a distribution from another IRA that was subsequently rolled over. (This rule does not apply to a delay

in the acquisition of a residence for a first time home buyer.)

3. I am not rolling over any required minimum distributions with respect to the distributing IRA plan.

4. If this rollover contribution represents a distribution from a SIMPLE IRA and I have not participated in my employer’s SIMPLE Plan for 2 years, this rollover contribution is being

made into another SIMPLE IRA.

Date employee first participated in original SIMPLE IRA: ____________________

1 of 2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2