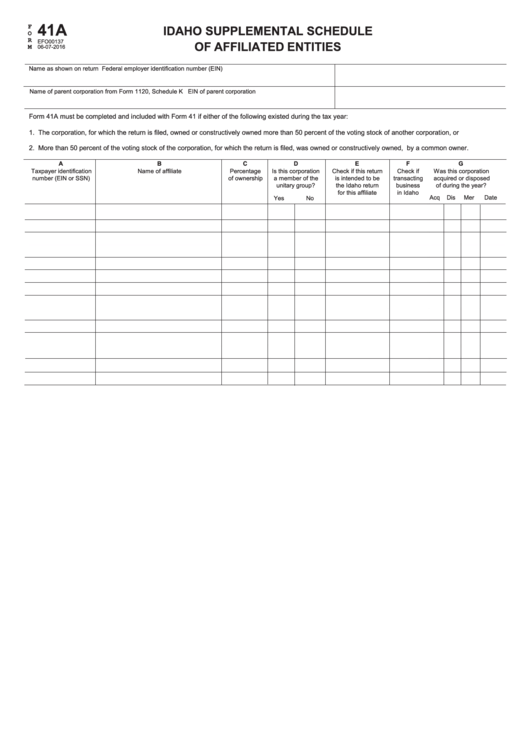

Form 41a - Idaho Supplemental Schedule Of Affiliated Entities

ADVERTISEMENT

41A

F

IDAHO SUPPLEMENTAL SCHEDULE

O

R

EFO00137

OF AFFILIATED ENTITIES

M

06-07-2016

Name as shown on return

Federal employer identification number (EIN)

Name of parent corporation from Form 1120, Schedule K

EIN of parent corporation

Form 41A must be completed and included with Form 41 if either of the following existed during the tax year:

1. The corporation, for which the return is filed, owned or constructively owned more than 50 percent of the voting stock of another corporation, or

2. More than 50 percent of the voting stock of the corporation, for which the return is filed, was owned or constructively owned, by a common owner.

A

B

C

D

E

F

G

Taxpayer identification

Name of affiliate

Percentage

Is this corporation

Check if this return

Check if

Was this corporation

number (EIN or SSN)

of ownership

a member of the

is intended to be

transacting

acquired or disposed

unitary group?

the Idaho return

business

of during the year?

for this affiliate

in Idaho

Acq

Dis

Mer

Date

Yes

No

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1