Questions And Answers About The New 100% Disabled Veteran'S Homestead Exemption - Texas Veterans Land Board

ADVERTISEMENT

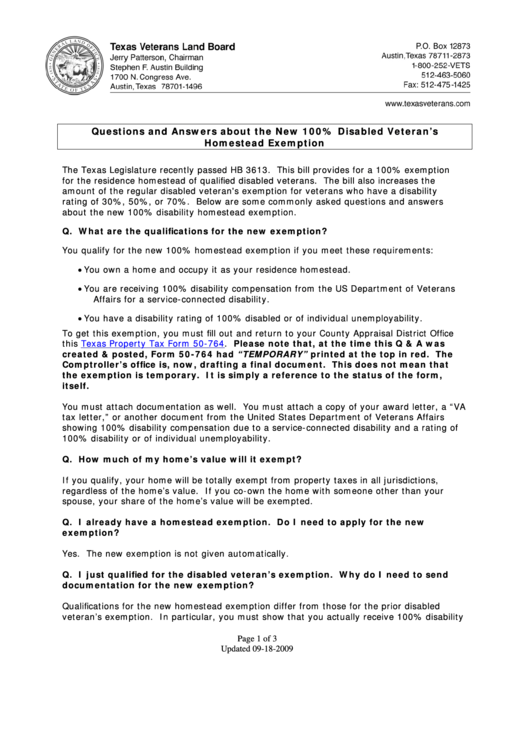

Questions and Answers about the New 100% Disabled Veteran’s

Homestead Exemption

The Texas Legislature recently passed HB 3613. This bill provides for a 100% exemption

for the residence homestead of qualified disabled veterans. The bill also increases the

amount of the regular disabled veteran's exemption for veterans who have a disability

rating of 30%, 50%, or 70%. Below are some commonly asked questions and answers

about the new 100% disability homestead exemption.

Q. What are the qualifications for the new exemption?

You qualify for the new 100% homestead exemption if you meet these requirements:

•

You own a home and occupy it as your residence homestead.

•

You are receiving 100% disability compensation from the US Department of Veterans

Affairs for a service-connected disability.

•

You have a disability rating of 100% disabled or of individual unemployability.

To get this exemption, you must fill out and return to your County Appraisal District Office

this

Texas Property Tax Form

50-764. Please note that, at the time this Q & A was

created & posted, Form 50-764 had “TEMPORARY” printed at the top in red. The

Comptroller’s office is, now, drafting a final document. This does not mean that

the exemption is temporary. It is simply a reference to the status of the form,

itself.

You must attach documentation as well. You must attach a copy of your award letter, a “VA

tax letter,” or another document from the United States Department of Veterans Affairs

showing 100% disability compensation due to a service-connected disability and a rating of

100% disability or of individual unemployability.

Q. How much of my home’s value will it exempt?

If you qualify, your home will be totally exempt from property taxes in all jurisdictions,

regardless of the home’s value. If you co-own the home with someone other than your

spouse, your share of the home’s value will be exempted.

Q. I already have a homestead exemption. Do I need to apply for the new

exemption?

Yes. The new exemption is not given automatically.

Q. I just qualified for the disabled veteran’s exemption. Why do I need to send

documentation for the new exemption?

Qualifications for the new homestead exemption differ from those for the prior disabled

veteran’s exemption. In particular, you must show that you actually receive 100% disability

Page 1 of 3

Updated 09-18-2009

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2 3

3