Form 500v - Virginia Corporation Income Tax Payment Voucher

ADVERTISEMENT

Attention: The payment for the total due on Form 500 must be

made through the e-File system (when filing the return) through

the eForms system, or with an ACH Credit from your bank.

Use this voucher only if you have an approved waiver. To request

a waiver, follow the instructions at: or call

(804) 367-8037 to obtain a waiver request form.

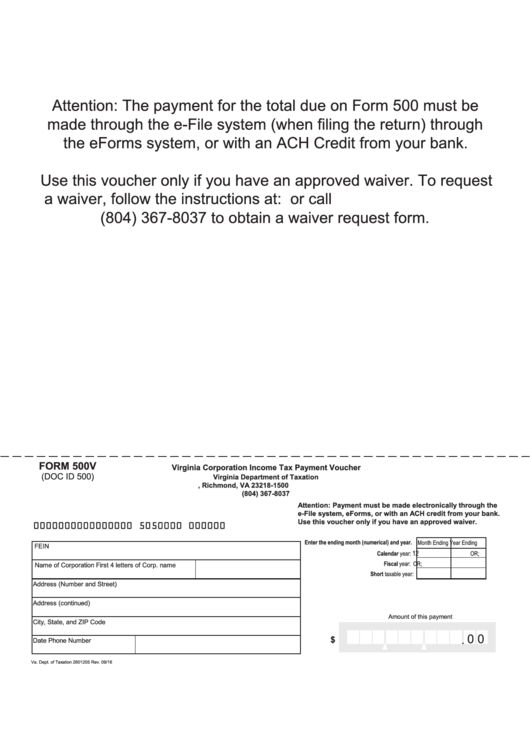

FORM 500V

Virginia Corporation Income Tax Payment Voucher

(DOC ID 500)

Virginia Department of Taxation

P.O. Box 1500, Richmond, VA 23218-1500

(804) 367-8037

Attention: Payment must be made electronically through the

e-File system, eForms, or with an ACH credit from your bank.

Use this voucher only if you have an approved waiver.

0000000000000000 5050000 000000

Enter the ending month (numerical) and year.

Month Ending

Year Ending

FEIN

12

Calendar year:

OR;

Fiscal year:

OR;

Name of Corporation

First 4 letters of Corp. name

Short taxable year:

Address (Number and Street)

Address (continued)

Amount of this payment

City, State, and ZIP Code

0 0

.

$

Date

Phone Number

Va. Dept. of Taxation 2601205 Rev. 09/16

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1