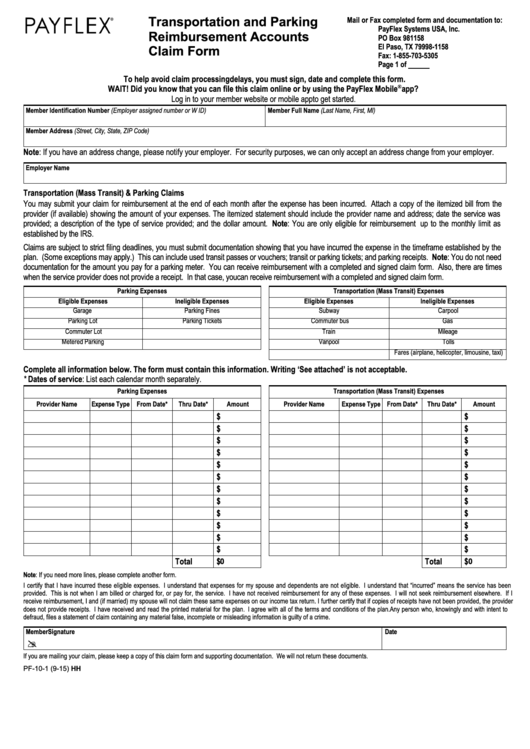

Form Pf-10-1 - Transportation And Parking Reimbursement Claim Form

ADVERTISEMENT

Transportation and Parking

Mail or Fax completed form and documentation to:

PayFlex Systems USA, Inc.

Reimbursement Accounts

PO Box 981158

El Paso, TX 79998-1158

Claim Form

Fax: 1-855-703-5305

Page 1 of

To help avoid claim processing delays, you must sign, date and complete this form.

WAIT! Did you know that you can file this claim online or by using the PayFlex Mobile

app ?

®

Log in to your member website or mobile app to get started.

Member Identification Number (Employer assigned number or W ID)

Member Full Name (Last Name, First, MI)

Member Address (Street, City, State, ZIP Code)

Note: If you have an address change, please notify your employer. For security purposes, we can only accept an address change from your employer.

Employer Name

Transportation (Mass Transit) & Parking Claims

You may submit your claim for reimbursement at the end of each month after the expense has been incurred. Attach a copy of the itemized bill from the

provider (if available) showing the amount of your expenses. The itemized statement should include the provider name and address; date the service was

provided; a description of the type of service provided; and the dollar amount. Note: You are only eligible for reimbursement up to the monthly limit as

established by the IRS.

Claims are subject to strict filing deadlines, you must submit documentation showing that you have incurred the expense in the timeframe established by the

plan. (Some exceptions may apply.) This can include used transit passes or vouchers; transit or parking tickets; and parking receipts. Note: You do not need

documentation for the amount you pay for a parking meter. You can receive reimbursement with a completed and signed claim form. Also, there are times

when the service provider does not provide a receipt. In that case, you can receive reimbursement with a completed and signed claim form.

Parking Expenses

Transportation (Mass Transit) Expenses

Eligible Expenses

Ineligible Expenses

Eligible Expenses

Ineligible Expenses

Garage

Parking Fines

Subway

Carpool

Parking Lot

Parking Tickets

Commuter bus

Gas

Commuter Lot

Train

Mileage

Metered Parking

Vanpool

Tolls

Fares (airplane, helicopter, limousine, taxi)

Complete all information below. The form must contain this information. Writing ‘See attached’ is not acceptable.

* Dates of service: List each calendar month separately.

Parking Expenses

Transportation (Mass Transit) Expenses

Provider Name

Expense Type From Date*

Thru Date*

Amount

Provider Name

Expense Type From Date*

Thru Date*

Amount

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

Total

$

Total

$

0

0

Note: If you need more lines, please complete another form.

I certify that I have incurred these eligible expenses. I understand that expenses for my spouse and dependents are not eligible. I understand that “incurred” means the service has been

provided. This is not when I am billed or charged for, or pay for, the service. I have not received reimbursement for any of these expenses. I will not seek reimbursement elsewhere. If I

receive reimbursement, I and (if married) my spouse will not claim these same expenses on our income tax return. I further certify that if copies of receipts have not been provided, the provider

does not provide receipts. I have received and read the printed material for the plan. I agree with all of the terms and conditions of the plan. Any person who, knowingly and with intent to

defraud, files a statement of claim containing any material false, incomplete or misleading information is guilty of a crime.

Member Signature

Date

If you are mailing your claim, please keep a copy of this claim form and supporting documentation. We will not return these documents.

PF-10-1 (9-15) HH

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1