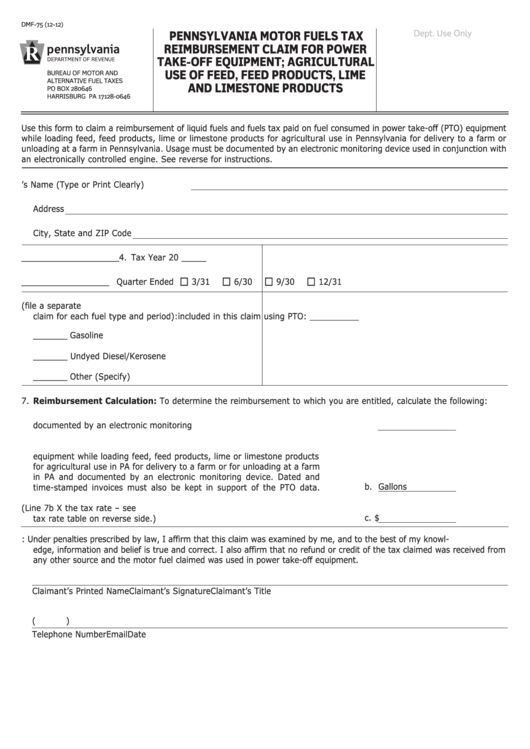

Form Dmf-75 - Pennsylvania Motor Fuels Tax Reimbursement Claim For Power Take-Off Equipment; Agricultural Use Of Feed, Feed Products, Lime And Limestone Products

ADVERTISEMENT

DMF-75 (12-12)

Dept. Use Only

PENNSYLVANIA MOTOR FUELS TAX

REIMBURSEMENT CLAIM FOR POWER

TAKE-OFF EQUIPMENT; AGRICULTURAL

USE OF FEED, FEED PRODUCTS, LIME

BUREAU OF MOTOR AND

ALTERNATIVE FUEL TAXES

AND LIMESTONE PRODUCTS

PO BOX 280646

HARRISBURG PA 17128-0646

Use this form to claim a reimbursement of liquid fuels and fuels tax paid on fuel consumed in power take-off (PTO) equipment

while loading feed, feed products, lime or limestone products for agricultural use in Pennsylvania for delivery to a farm or

unloading at a farm in Pennsylvania. Usage must be documented by an electronic monitoring device used in conjunction with

an electronically controlled engine. See reverse for instructions.

1. Claimant’s Name (Type or Print Clearly)

Address

City, State and ZIP Code

2. Fedederal Employer ID Number ____________________ 4. Tax Year 20 _____

®

®

®

®

3. PA Sales/Use Tax License Number __________________ Quarter Ended

3/31

6/30

9/30

12/31

5. Indicate fuel type (file a separate

6. Number of pieces of equipment

claim for each fuel type and period):

included in this claim using PTO: __________

_______ Gasoline

_______ Undyed Diesel/Kerosene

_______ Other (Specify)

7. Reimbursement Calculation: To determine the reimbursement to which you are entitled, calculate the following:

a. Total gallons of fuel consumed in Pennsylvania using PTO equipment and

documented by an electronic monitoring device.

a.

Gallons

b. Gallons of fuel included in Line 7a that were consumed in PA using PTO

equipment while loading feed, feed products, lime or limestone products

for agricultural use in PA for delivery to a farm or for unloading at a farm

in PA and documented by an electronic monitoring device. Dated and

b.

Gallons

time-stamped invoices must also be kept in support of the PTO data.

c. Total Reimbursement Requested. (Line 7b X the tax rate – see

c. $

tax rate table on reverse side.)

8. Certification: Under penalties prescribed by law, I affirm that this claim was examined by me, and to the best of my knowl-

edge, information and belief is true and correct. I also affirm that no refund or credit of the tax claimed was received from

any other source and the motor fuel claimed was used in power take-off equipment.

Claimant’s Printed Name

Claimant’s Signature

Claimant’s Title

(

)

Telephone Number

Email

Date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2