Certificate Of Nonforeign Status Form (Firpta)

ADVERTISEMENT

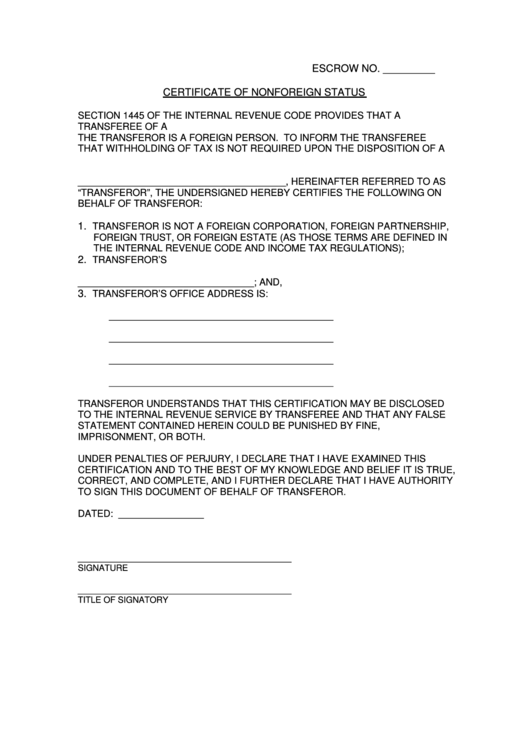

ESCROW NO. _________

CERTIFICATE OF NONFOREIGN STATUS

SECTION 1445 OF THE INTERNAL REVENUE CODE PROVIDES THAT A

TRANSFEREE OF A U.S. REAL PROPERTY INTEREST MUST WITHHOLD TAX IF

THE TRANSFEROR IS A FOREIGN PERSON. TO INFORM THE TRANSFEREE

THAT WITHHOLDING OF TAX IS NOT REQUIRED UPON THE DISPOSITION OF A

U.S. REAL PROPERTY INTEREST BY

_______________________________________, HEREINAFTER REFERRED TO AS

“TRANSFEROR”, THE UNDERSIGNED HEREBY CERTIFIES THE FOLLOWING ON

BEHALF OF TRANSFEROR:

1.

TRANSFEROR IS NOT A FOREIGN CORPORATION, FOREIGN PARTNERSHIP,

FOREIGN TRUST, OR FOREIGN ESTATE (AS THOSE TERMS ARE DEFINED IN

THE INTERNAL REVENUE CODE AND INCOME TAX REGULATIONS);

2.

TRANSFEROR’S U.S. EMPLOYER IDENTIFICATION NUMBER IS

_________________________________; AND,

3.

TRANSFEROR’S OFFICE ADDRESS IS:

__________________________________________

__________________________________________

__________________________________________

__________________________________________

TRANSFEROR UNDERSTANDS THAT THIS CERTIFICATION MAY BE DISCLOSED

TO THE INTERNAL REVENUE SERVICE BY TRANSFEREE AND THAT ANY FALSE

STATEMENT CONTAINED HEREIN COULD BE PUNISHED BY FINE,

IMPRISONMENT, OR BOTH.

UNDER PENALTIES OF PERJURY, I DECLARE THAT I HAVE EXAMINED THIS

CERTIFICATION AND TO THE BEST OF MY KNOWLEDGE AND BELIEF IT IS TRUE,

CORRECT, AND COMPLETE, AND I FURTHER DECLARE THAT I HAVE AUTHORITY

TO SIGN THIS DOCUMENT OF BEHALF OF TRANSFEROR.

DATED: ________________

________________________________________

SIGNATURE

________________________________________

TITLE OF SIGNATORY

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1