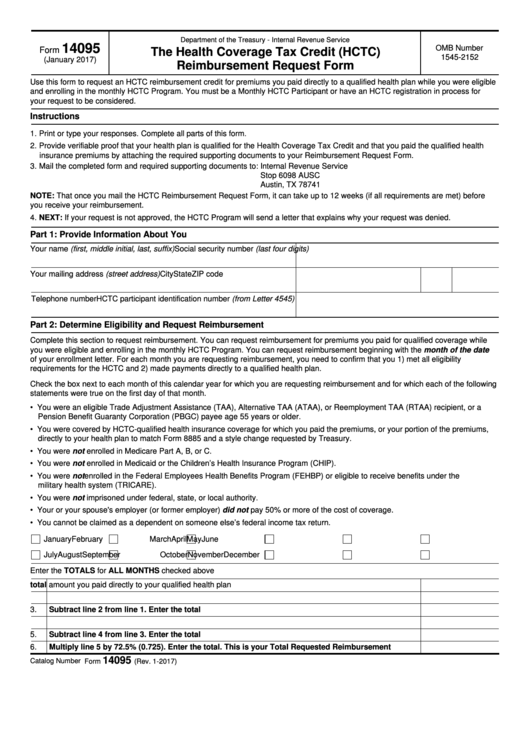

Form 14095 - Department Of The Treasury - Internal Revenue Service The Health Coverage Tax Credit (Hctc) Reimbursement Request Form

ADVERTISEMENT

Department of the Treasury - Internal Revenue Service

14095

OMB Number

Form

The Health Coverage Tax Credit (HCTC)

1545-2152

(January 2017)

Reimbursement Request Form

Use this form to request an HCTC reimbursement credit for premiums you paid directly to a qualified health plan while you were eligible

and enrolling in the monthly HCTC Program. You must be a Monthly HCTC Participant or have an HCTC registration in process for

your request to be considered.

Instructions

1. Print or type your responses. Complete all parts of this form.

2. Provide verifiable proof that your health plan is qualified for the Health Coverage Tax Credit and that you paid the qualified health

insurance premiums by attaching the required supporting documents to your Reimbursement Request Form.

3. Mail the completed form and required supporting documents to: Internal Revenue Service

Stop 6098 AUSC

Austin, TX 78741

NOTE: That once you mail the HCTC Reimbursement Request Form, it can take up to 12 weeks (if all requirements are met) before

you receive your reimbursement.

4. NEXT: If your request is not approved, the HCTC Program will send a letter that explains why your request was denied.

Part 1: Provide Information About You

Your name (first, middle initial, last, suffix)

Social security number (last four digits)

Your mailing address (street address)

City

State

ZIP code

Telephone number

HCTC participant identification number (from Letter 4545)

Part 2: Determine Eligibility and Request Reimbursement

Complete this section to request reimbursement. You can request reimbursement for premiums you paid for qualified coverage while

you were eligible and enrolling in the monthly HCTC Program. You can request reimbursement beginning with the month of the date

of your enrollment letter. For each month you are requesting reimbursement, you need to confirm that you 1) met all eligibility

requirements for the HCTC and 2) made payments directly to a qualified health plan.

Check the box next to each month of this calendar year for which you are requesting reimbursement and for which each of the following

statements were true on the first day of that month.

• You were an eligible Trade Adjustment Assistance (TAA), Alternative TAA (ATAA), or Reemployment TAA (RTAA) recipient, or a

Pension Benefit Guaranty Corporation (PBGC) payee age 55 years or older.

• You were covered by HCTC-qualified health insurance coverage for which you paid the premiums, or your portion of the premiums,

directly to your health plan to match Form 8885 and a style change requested by Treasury.

• You were not enrolled in Medicare Part A, B, or C.

• You were not enrolled in Medicaid or the Children’s Health Insurance Program (CHIP).

• You were not enrolled in the Federal Employees Health Benefits Program (FEHBP) or eligible to receive benefits under the U.S.

military health system (TRICARE).

• You were not imprisoned under federal, state, or local authority.

• Your or your spouse's employer (or former employer) did not pay 50% or more of the cost of coverage.

• You cannot be claimed as a dependent on someone else’s federal income tax return.

January

February

March

April

May

June

July

August

September

October

November

December

Enter the TOTALS for ALL MONTHS checked above

1.

Enter the total amount you paid directly to your qualified health plan

2.

Enter the total amount you paid for dental or vision benefits. These benefits do not qualify for the HCTC

3.

Subtract line 2 from line 1. Enter the total

4.

Enter total amount you paid for family members that are not qualified for the HCTC

5.

Subtract line 4 from line 3. Enter the total

6.

Multiply line 5 by 72.5% (0.725). Enter the total. This is your Total Requested Reimbursement

14095

Catalog Number 53672K

Form

(Rev. 1-2017)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2