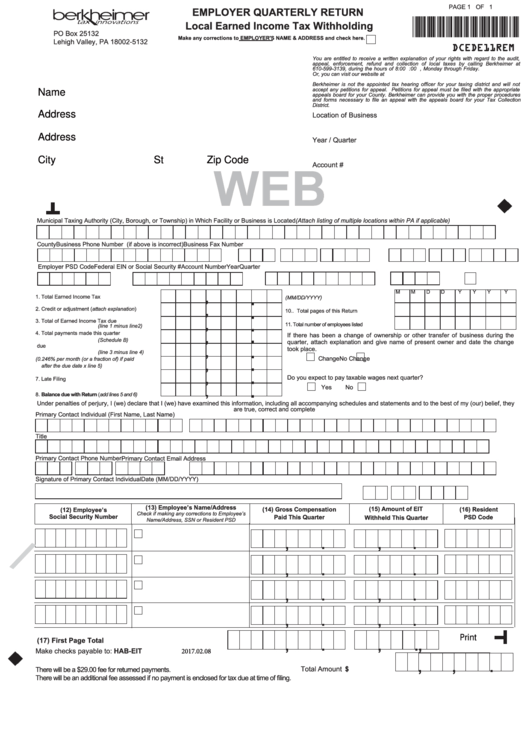

PAGE 1 OF 1

EMPLOYER QUARTERLY RETURN

*DCEDE11REM*

Local Earned Income Tax Withholding

PO Box 25132

Make any corrections to EMPLOYER'S NAME & ADDRESS and check here.

Lehigh Valley, PA 18002-5132

DCEDE11REM

You are entitled to receive a written explanation of your rights with regard to the audit,

appeal, enforcement, refund and collection of local taxes by calling Berkheimer at

610-599-3139, during the hours of 8:00 a.m. through 4:00 p.m., Monday through Friday.

Or, you can visit our website at

Berkheimer is not the appointed tax hearing officer for your taxing district and will not

Name

accept any petitions for appeal. Petitions for appeal must be filed with the appropriate

appeals board for your County. Berkheimer can provide you with the proper procedures

and forms necessary to file an appeal with the appeals board for your Tax Collection

District.

Address

Location of Business

Address

Year / Quarter

City

St

Zip Code

Account #

Municipal Taxing Authority (City, Borough, or Township) in Which Facility or Business is Located (Attach listing of multiple locations within PA if applicable)

County

Business Phone Number (if above is incorrect)

Business Fax Number

Employer PSD Code

Federal EIN or Social Security #

Account Number

Year

Quarter

M

M

D

D

Y

Y

Y

Y

.

,

1. Total Earned Income Tax withheld...........................

9. Date period ended (MM/DD/YYYY)............

.

2. Credit or adjustment (attach explanation)...............

,

10.. Total pages of this Return ...........................

3. Total of Earned Income Tax due

.

,

11. Total number of employees listed ...................

(line 1 minus line2)...........

4. Total payments made this quarter

.

If there has been a change of ownership or other transfer of business during the

,

(Schedule B)..............................

quarter, attach explanation and give name of present owner and date the change

5. Adjusted total of Earned Income Tax due

.

took place.

,

(line 3 minus line 4).........

Change

No Change

6. Interest (0.246% per month (or a fraction of) if paid

.

,

after the due date x line 5)......................................

.

,

Do you expect to pay taxable wages next quarter?

7. Late Filing Fee.......................................................

.

Yes

No

8. Balance due with Return (add lines 5 and 6) .................

Under penalties of perjury, I (we) declare that I (we) have examined this information, including all accompanying schedules and statements and to the best of my (our) belief, they

are true, correct and complete

Primary Contact Individual (First Name, Last Name)

Title

Primary Contact Phone Number

Primary Contact Email Address

Signature of Primary Contact Individual

Date (MM/DD/YYYY)

(13) Employee’s Name/Address

(15) Amount of EIT

(12) Employee’s

(14) Gross Compensation

(16) Resident

Check if making any corrections to Employee’s

Social Security Number

Paid This Quarter

PSD Code

Withheld This Quarter

Name/Address, SSN or Resident PSD

,

.

,

.

.

,

,

.

,

.

,

.

,

.

,

.

Print

(17) First Page Total .....................................................

,

,

.

,

.

2017.02.08

Make checks payable to: HAB-EIT

,

,

.

Total Amount Enclosed..... $

There will be a $29.00 fee for returned payments.

There will be an additional fee assessed if no payment is enclosed for tax due at time of filing.

1

1 2

2