Reset Form

Print Form

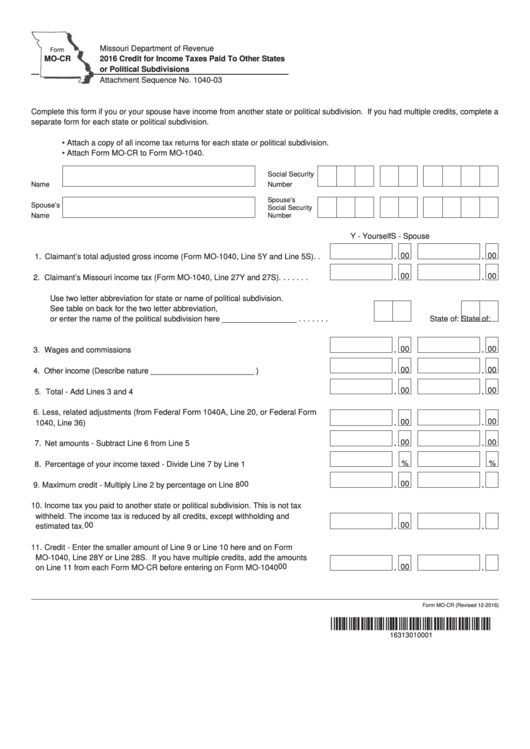

Missouri Department of Revenue

Form

MO-CR

2016 Credit for Income Taxes Paid To Other States

or Political Subdivisions

Attachment Sequence No. 1040-03

Complete this form if you or your spouse have income from another state or political subdivision. If you had multiple credits, complete a

separate form for each state or political subdivision.

• Attach a copy of all income tax returns for each state or political subdivision.

• Attach Form MO-CR to Form MO-1040.

Social Security

Name

Number

Spouse’s

Spouse’s

Social Security

Name

Number

Y - Yourself

S - Spouse

.

.

00

00

1. Claimant’s total adjusted gross income (Form MO-1040, Line 5Y and Line 5S) . .

.

.

00

00

2. Claimant’s Missouri income tax (Form MO-1040, Line 27Y and 27S). . . . . . .

Use two letter abbreviation for state or name of political subdivision.

See table on back for the two letter abbreviation,

or enter the name of the political subdivision here _________________ . . . . . . .

State of:

State of:

.

.

00

00

3. Wages and commissions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

.

.

00

00

4. Other income (Describe nature ________________________ ) . . . . . . . . . . . . . . . .

.

.

00

00

5. Total - Add Lines 3 and 4 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6. Less, related adjustments (from Federal Form 1040A, Line 20, or Federal Form

.

.

00

00

1040, Line 36) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

.

.

00

00

7. Net amounts - Subtract Line 6 from Line 5 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

%

%

8. Percentage of your income taxed - Divide Line 7 by Line 1 . . . . . . . . . . . . . . . . . .

.

.

00

00

9. Maximum credit - Multiply Line 2 by percentage on Line 8 . . . . . . . . . . . . . . . . . . .

10. Income tax you paid to another state or political subdivision. This is not tax

withheld. The income tax is reduced by all credits, except withholding and

.

.

00

00

estimated tax. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11. Credit - Enter the smaller amount of Line 9 or Line 10 here and on Form

MO-1040, Line 28Y or Line 28S. If you have multiple credits, add the amounts

.

.

00

00

on Line 11 from each Form MO-CR before entering on Form MO-1040 . . . . . . . .

Form MO-CR (Revised 12-2016)

*16313010001*

16313010001

1

1 2

2