P r o p e r t y T a x

P r o p e r t y A p p r a i s a l – N o t i c e o f P r o t e s t

Form 50-132

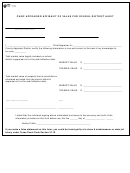

STEP 3: Check Reasons for Your Protest

Failure to check a box may result in your inability to protest an issue. If you check “value is over market value,” you are indicating that the appraised value is excessive

and your property would not sell for the amount determined by the appraisal district. If you check “value is unequal as compared to other properties,” you are indicating

that your property is not appraised at the same level as a representative sample of comparable properties, appropriately adjusted for condition, size, location, and

other factors. Your property may be appraised at its market value, but be unequally appraised. An appraisal review board may adjust your value to equalize it with other

comparable properties. Please check all boxes that apply in order to preserve your rights so that the appraisal review board may consider your protest according to law.

Value is over market value.

Change in use of land appraised as ag-use, open-space or timber land.

Value is unequal compared with other properties.

Ag-use, open-space or other special appraisal was denied, modified or cancelled.

Owner’s name is incorrect.

_______________________

Property should not be taxed in

.

(name of taxing unit)

Property description is incorrect.

_______________________

Property should not be taxed in this appraisal district or in one or more taxing units.

Failure to send required notice.

.

(type)

___________________________________________

Exemption was denied, modified or cancelled.

Other:

.

STEP 4: Give Facts That May Help Resolve Your Case

______________________________

What do you think your property’s value is? (Optional)

$

STEP 5: Check to Receive ARB Hearing Procedures

I want the ARB to send me a copy of its hearing procedures.

Yes

No*

* If your protest goes to a hearing, you will automatically receive a copy of the ARB’s hearing procedures.

STEP 6: Signature

______________________________________________________________

Print Name

______________________________________________________________

___________________________

Signature

Date

For more information, visit our website:

Page 2 • 50-132 • 10-13/12

1

1 2

2