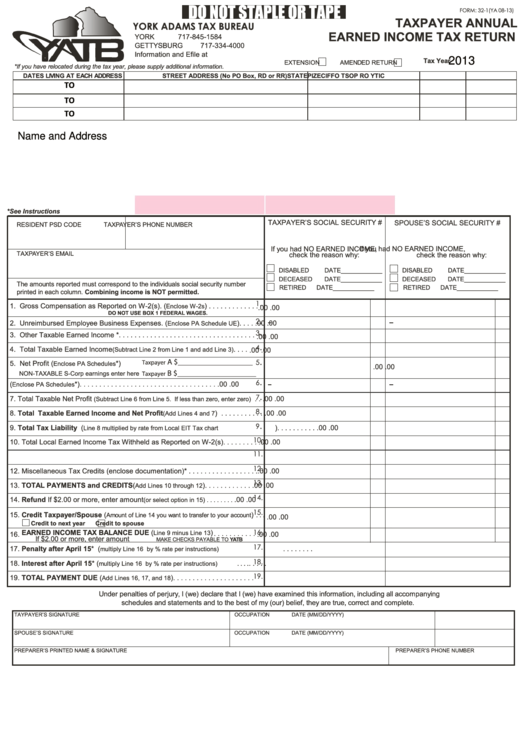

DO NOT STAPLE OR TAPE

FORM: 32-1(YA 08-13)

TAXPAYER ANNUAL

YORK ADAMS TAX BUREAU

EARNED INCOME TAX RETURN

YORK

717-845-1584

GETTYSBURG

717-334-4000

Information and Efile at

2013

Tax Year

EXTENSION

AMENDED RETURN

*If you have relocated during the tax year, please supply additional information.

DATES LIVING AT EACH ADDRESS

STREET ADDRESS (No PO Box, RD or RR)

C

T I

Y

O

R

P

O

S

T

O

F

F

C I

E

STATE

Z

P I

TO

TO

TO

Name and Address

*See Instructions

TAXPAYER’S SOCIAL SECURITY #

SPOUSE’S SOCIAL SECURITY #

RESIDENT PSD CODE

TAXPAYER’S PHONE NUMBER

If you had NO EARNED INCOME,

If you had NO EARNED INCOME,

TAXPAYER’S EMAIL

check the reason why:

check the reason why:

DISABLED

DATE____________

DISABLED

DATE____________

DECEASED

DATE____________

DECEASED

DATE____________

The amounts reported must correspond to the individuals social security number

RETIRED

DATE____________

RETIRED

DATE____________

printed in each column. Combining income is NOT permitted.

1.

1. Gross Compensation as Reported on W-2(s). (

) . . . . . . . . . . . . .

Enclose W-2s

.00

.00

DO NOT USE BOX 1 FEDERAL WAGES.

.

2

2. Unreimbursed Employee Business Expenses. (

) . . . .

.00

.00

Enclose PA Schedule UE

.

3

3. Other Taxable Earned Income * . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

.00

.00

.

4

4. Total Taxable Earned Income

. . . .

(Subtract Line 2 from Line 1 and add Line 3)

.00

.00

.

A $___________________

5

5. Net Profit (

*)

Taxpayer

Enclose PA Schedules

.00

.00

B $____________________

NON-TAXABLE S-Corp earnings enter here

Taxpayer

.

6

6. Net Loss (

*) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

.00

.00

Enclose PA Schedules

.

7

7. Total Taxable Net Profit

. .

.00

.00

(Subtract Line 6 from Line 5. If less than zero, enter zero)

.

8

8. Total Taxable Earned Income and Net Profit

) . . . . . . . . . . .

.00

.00

(Add Lines 4 and 7

.

9

9. Total Tax Liability (

) . . . . . . . . . .

.00

.00

Line 8 multiplied by rate from Local EIT Tax chart

10.

10. Total Local Earned Income Tax Withheld as Reported on W-2(s) . . . . . . . . .

.00

.00

11.

11.Quarterly Estimated Payments/Credit From Previous Tax Year . . . . . . . . . . .

.00

.00

12.

12. Miscellaneous Tax Credits (enclose documentation)* . . . . . . . . . . . . . . . . . .

.00

.00

13.

13. TOTAL PAYMENTS and CREDITS (

) . . . . . . . . . . . .

.00

.00

Add Lines 10 through 12

14.

14. Refund If $2.00 or more, enter amount

.00

.00

(or select option in 15) . . . . . . . .

15.

15. Credit Taxpayer/Spouse (

) . . .

Amount of Line 14 you want to transfer to your account

.00

.00

Credit to next year

Credit to spouse

16. EARNED INCOME TAX BALANCE DUE (

) . . . . . . . . . . .

16.

Line 9 minus Line 13

.00

.00

If $2.00 or more, enter amount

MAKE CHECKS PAYABLE TO YATB

17.

17. Penalty after April 15* (

. . . . . . . .

multiply Line 16 by % rate per instructions)

18.

18. Interest after April 15* (

. . . . . . . . .

multiply Line 16 by % rate per instructions)

19.

19. TOTAL PAYMENT DUE (

) . . . . . . . . . . . . . . . . . . . . .

Add Lines 16, 17, and 18

Under penalties of perjury, I (we) declare that I (we) have examined this information, including all accompanying

schedules and statements and to the best of my (our) belief, they are true, correct and complete.

TAYPAYER’S SIGNATURE

OCCUPATION

DATE (MM/DD/YYYY)

SPOUSE’S SIGNATURE

OCCUPATION

DATE (MM/DD/YYYY)

PREPARER’S PRINTED NAME & SIGNATURE

PREPARER’S PHONE NUMBER

1

1