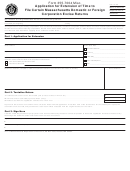

Form 355-7004 - Corporate Extension Worksheet - 2016 Page 2

ADVERTISEMENT

Who May Sign?

Form 355-7004 must be signed by the treasurer or assistant trea -

surer of the corporation or by a person authorized by the corpora-

tion to do so. An application signed by an unauthorized person will

be considered null and void. If a return is filed after the original due

date based on a void extension, interest and penalties will be as -

sessed back to the original due date.

Keep this worksheet with your records. Do not submit it with Form

355-7004. Mail the completed application to: Massachusetts De -

partment of Revenue, PO Box 7025, Boston, MA 02204.

Note: Under certain circumstances, if a payment is not required to

be submitted with the extension request, the requirement to file the

extension may be waived. For further information, see TIR 06-21.

Corporations with $100,000 or more in receipts or sales must submit

their extension request, as well as any accompanying payment, elec-

tronically. Also, any corporation making an extension payment of

$5,000 or more must make the payment using electronic means. For

further information, see TIR 15-9.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2