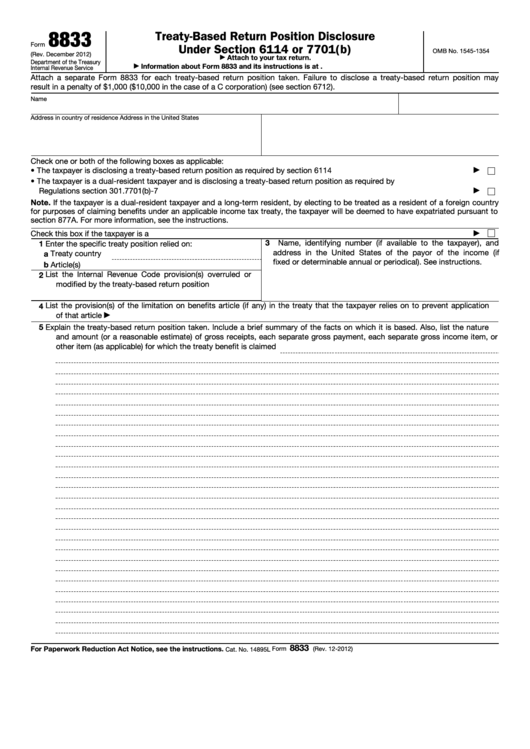

Form 8833 (Rev. December 2012) Treaty-Based Return Position Disclosure Under Section 6114 Or 7701(B)

ADVERTISEMENT

8833

Treaty-Based Return Position Disclosure

Form

Under Section 6114 or 7701(b)

OMB No. 1545-1354

(Rev. December 2012)

Attach to your tax return.

Department of the Treasury

Information about Form 8833 and its instructions is at

Internal Revenue Service

Attach a separate Form 8833 for each treaty-based return position taken. Failure to disclose a treaty-based return position may

result in a penalty of $1,000 ($10,000 in the case of a C corporation) (see section 6712).

U.S. taxpayer identifying number

Name

Address in country of residence

Address in the United States

Check one or both of the following boxes as applicable:

• The taxpayer is disclosing a treaty-based return position as required by section 6114

.

.

.

.

.

.

.

.

.

.

.

.

.

• The taxpayer is a dual-resident taxpayer and is disclosing a treaty-based return position as required by

Regulations section 301.7701(b)-7 .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

Note. If the taxpayer is a dual-resident taxpayer and a long-term resident, by electing to be treated as a resident of a foreign country

for purposes of claiming benefits under an applicable income tax treaty, the taxpayer will be deemed to have expatriated pursuant to

section 877A. For more information, see the instructions.

Check this box if the taxpayer is a U.S. citizen or resident or is incorporated in the United States

.

.

.

.

.

.

.

.

.

.

3

Name, identifying number (if available to the taxpayer), and

1

Enter the specific treaty position relied on:

address in the United States of the payor of the income (if

a Treaty country

fixed or determinable annual or periodical). See instructions.

b Article(s)

List the Internal Revenue Code provision(s) overruled or

2

modified by the treaty-based return position

List the provision(s) of the limitation on benefits article (if any) in the treaty that the taxpayer relies on to prevent application

4

of that article

5

Explain the treaty-based return position taken. Include a brief summary of the facts on which it is based. Also, list the nature

and amount (or a reasonable estimate) of gross receipts, each separate gross payment, each separate gross income item, or

other item (as applicable) for which the treaty benefit is claimed

8833

For Paperwork Reduction Act Notice, see the instructions.

Form

(Rev. 12-2012)

Cat. No. 14895L

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1