Instructions for Idaho Form 49

EFO00030p2

07-15-14

GENERAL INSTRUCTIONS

SPECIFIC INSTRUCTIONS

Form 49 is used to calculate the investment tax credit (ITC)

Instructions are for lines not fully explained on the form.

earned or allowed. Each member of a unitary group of

PART I - CREDIT AVAILABLE SUBJECT TO LIMITATION

corporations that earns or is allowed the credit must complete a

separate Form 49.

Line 1a. Include a list of all property you acquired and placed

in service during the tax year that qualifies for the ITC. The list

Property Used Both In and Outside Idaho

should identify each item of property, your basis in the item,

If property is used both in and outside Idaho, compute the

and the date placed in service. The basis of qualified property

qualified investment for all such property using one of the

is the Idaho adjusted basis computed without regard to bonus

following methods:

depreciation. Don't include any property on which you are

claiming the biofuel infrastructure investment tax credit, or any

1. Percentage-of-Use Method - Multiply the investment in each

property you are expensing under IRC Section 179.

asset by a fraction where Idaho use is the numerator and

total use is the denominator. Usage can be measured by

Line 1b. Enter the amount of qualified investments for which you

machine hours, mileage, or any other method that accu-

claimed the property tax exemption. This exemption is allowed in

rately reflects the usage.

lieu of earning the ITC. Include applicable Form(s) 49E.

2. Property Factor Numerator Method - Use the amount

correctly included in the Idaho property numerator for each

Line 3. Include a list of all ITC that is being passed through by

asset.

partnerships, S corporations, estates, or trusts in which you have

an interest. This amount is reported on Form ID K-1, Part D,

The amount computed in method #2 will generally be the same

line 1. The list should identify each entity by name, EIN, and the

as that computed in method #1 unless your business uses

amount of ITC that is being passed through.

the Multistate Tax Commission special industry regulations to

compute its factors.

Line 4. If you are a member of a unitary group, enter the amount

of credit you received from another member of the unitary group.

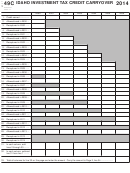

Carryover Periods

Compute the ITC carryover on Form 49C.

Line 5. Enter the ITC carryover from prior years. The amount

● For property acquired after 1989 but prior to tax years

is computed on Form 49C or on a separate schedule. Include a

beginning in 2000, the credit carryover is limited to seven

copy of Form 49C or the schedule. See General Instructions for

tax years unless the credit has not been carried over seven

the carryover period allowed.

tax years before 2000. If the credit has been carried for-

ward less than seven tax years, and is eligible for carryover

Line 6. If you are a partnership, S corporation, trust, or estate,

to tax years beginning on or after 2000, the carryover period

enter the amount of credit that passed through to partners,

is limited to 14 tax years.

shareholders, or beneficiaries.

● For credit earned in tax years beginning on or after January

1, 2000, the credit carryover is limited to 14 tax years.

Line 7. If you are a member of a unitary group, enter the amount

of credit you earned that you elect to share with other members

For purposes of the carryover period, a short tax year counts as

of your unitary group. Before you can share your credit, you must

use the credit up to the allowable limitation of your tax liability.

one tax year.

Election to Claim Two-Year Property Tax Exemption and

Corporations claiming ITC must provide a calculation of the credit

Forgo Investment Tax Credit

earned and used by each member of the combined group. The

schedule must clearly identify shared credit and the computation

If you placed personal property in service that qualifies for the

of any credit carryovers.

ITC, you may elect to exempt this property from your property

tax. You aren't eligible for the election if your rate of charge

PART II - LIMITATION

or rate of return is regulated or limited by federal or state law.

The ITC is limited to 50% of your Idaho income tax after

The exemption from the property tax is for two years. After the

deducting:

two years, you must pay any applicable property tax. You can't

● Credit for taxes paid to other states

claim the ITC for any property that you elect to exempt from

● Credit for contributions to Idaho educational entities

property tax.

Line 1. Enter the amount of your Idaho income tax. This is the

The election is available if you had negative Idaho taxable

computed tax before adding the permanent building fund tax or

income in the second preceding tax year from the tax year

any other taxes, or subtracting any credits.

in which the property was placed in service. Negative Idaho

taxable income must have been computed without regard to

Line 2. Enter the credit for tax paid to other states from Form

any carryover or carryback of net operating losses.

39R or Form 39NR. This credit is available only to individuals,

estates, and trusts.

The election must be made on Form 49E and filed with the

operator's statement or personal property declaration. A copy

Line 8. Enter the smallest amount from lines 5, 6, or 7. Carry

of the election form must be included with the original income

this amount to Form 44, Part I, line 1, and enter it in the Credit

tax return(s) for the tax year(s) in which the property was placed

in service.

Allowed column.

Biofuel Infrastructure Investment Tax Credit

If you placed biofuel infrastructure in service during the tax year

and are claiming the biofuel infrastructure investment tax credit,

you can't claim the ITC on the same property.

Recapture

You must compute recapture if you sell or otherwise dispose of

the property or it ceases to qualify for the ITC before it has been

in service for five full years. File Form 49ER if you claimed the

property tax exemption. File Form 49R if you claimed the ITC.

1

1 2

2