Mutual Agreement For Monroe County To Accept Land Via Quit Claim Deed

ADVERTISEMENT

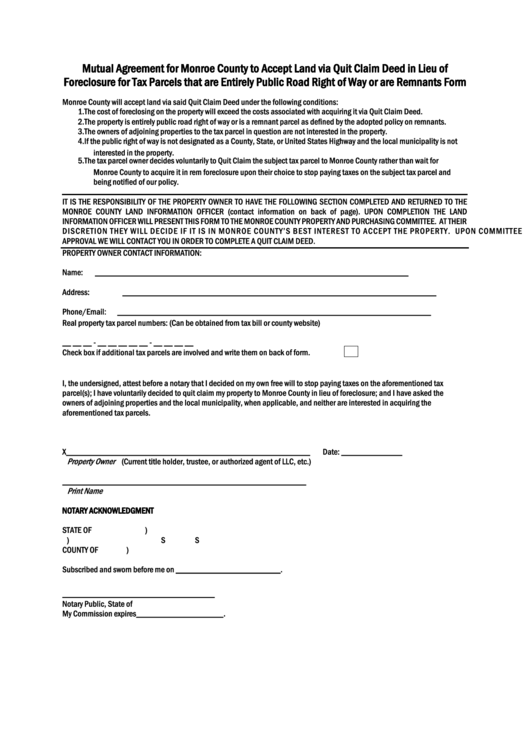

Mutual Agreement for Monroe County to Accept Land via Quit Claim Deed in Lieu of

Foreclosure for Tax Parcels that are Entirely Public Road Right of Way or are Remnants Form

Monroe County will accept land via said Quit Claim Deed under the following conditions:

1. The cost of foreclosing on the property will exceed the costs associated with acquiring it via Quit Claim Deed.

2. The property is entirely public road right of way or is a remnant parcel as defined by the adopted policy on remnants.

3. The owners of adjoining properties to the tax parcel in question are not interested in the property.

4. If the public right of way is not designated as a County, State, or United States Highway and the local municipality is not

interested in the property.

5. The tax parcel owner decides voluntarily to Quit Claim the subject tax parcel to Monroe County rather than wait for

Monroe County to acquire it in rem foreclosure upon their choice to stop paying taxes on the subject tax parcel and

being notified of our policy.

IT IS THE RESPONSIBILITY OF THE PROPERTY OWNER TO HAVE THE FOLLOWING SECTION COMPLETED AND RETURNED TO THE

MONROE COUNTY LAND INFORMATION OFFICER (contact information on back of page). UPON COMPLETION THE LAND

INFORMATION OFFICER WILL PRESENT THIS FORM TO THE MONROE COUNTY PROPERTY AND PURCHASING COMMITTEE. AT THEIR

DISCRETION THEY WILL DECIDE IF IT IS IN MONROE COUNTY’S BEST INTEREST TO ACCEPT THE PROPERTY. UPON COMMITTEE

APPROVAL WE WILL CONTACT YOU IN ORDER TO COMPLETE A QUIT CLAIM DEED.

PROPERTY OWNER CONTACT INFORMATION:

Name:

________________________________________________________________________

Address:

________________________________________________________________________

Phone/Email:

________________________________________________________________________

Real property tax parcel numbers: (Can be obtained from tax bill or county website)

__ __ __ - __ __ __ __ __ - __ __ __ __

Check box if additional tax parcels are involved and write them on back of form.

I, the undersigned, attest before a notary that I decided on my own free will to stop paying taxes on the aforementioned tax

parcel(s); I have voluntarily decided to quit claim my property to Monroe County in lieu of foreclosure; and I have asked the

owners of adjoining properties and the local municipality, when applicable, and neither are interested in acquiring the

aforementioned tax parcels.

X________________________________________________________

Date: ______________

Property Owner

(Current title holder, trustee, or authorized agent of LLC, etc.)

________________________________________________________

Print Name

NOTARY ACKNOWLEDGMENT

STATE OF

)

) SS

COUNTY OF

)

Subscribed and sworn before me on ________________________.

___________________________________

Notary Public, State of

My Commission expires____________________.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2