Dependent Care

How to File a Claim for Approval

Dependent Care

Claim Filing Options:

Pay Me Back Claim Form

File claim online - Log in to your account at to submit your claim electronically.

File claim online - Join the growing majority of participants who submit their claim

File claim via fax or mail - Claim details may be entered online and a completed form may be printed and faxed or mailed with

online for faster service. Log in to your account at to file your

claim electronically and upload your documentation.

documentation. Fax: 877-353-9236, US Mail: CLAIMS ADMINISTRATOR, P.O. Box 14053, Lexington, KY, 40512

File claim via fax or mail - Claim forms may also be filed either via fax or US Mail and sent

to the following locations:

Fax: 877-353-9236, US Mail: CLAIMS ADMINISTRATOR, P.O. Box 14053, Lexington, KY, 40512

Claim processing time - Claims will be processed within 2 business days after WageWorks receives the

form. You may check the status of your claim by logging into your account at .

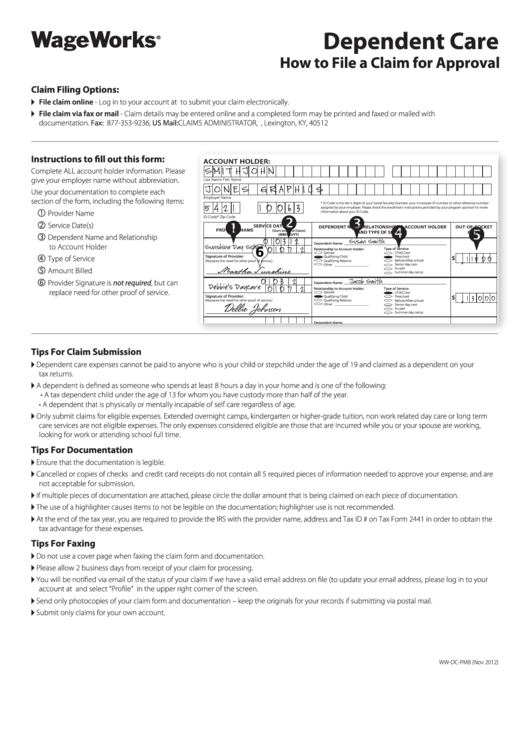

Instructions to fill out this form:

ACCOUNT HOLDER:

S M I T H

J O H N

Complete ALL account holder information. Please

give your employer name without abbreviation.

Last Name

First Name

J O N E S

G R A P H I C S

Use your documentation to complete each

Employer Name

section of the form, including the following items:

* ID Code is the last 4 digits of your Social Security Number, your Employee ID number or other reference number

5 4 2 1

1 0 0 6 3

assigned by your employer. Please check the enrollment instructions provided by your program sponsor for more

Provider Name

information about your ID Code.

ID Code*

Zip Code

‚

Service Date(s)

SERVICE DATES

DEPENDENT NAME, RELATIONSHIP TO ACCOUNT HOLDER

OUT-OF-POCKET

PROVIDER NAME

(Start and End Dates)

AND TYPE OF SERVICE

COST

ƒ

(MM/DD/YY)

Dependent Name and Relationship

0 1 0 3 1 2

Susan Smith

Dependent Name: ______________________________________________________

to Account Holder

Sunshine Day School

0 1 0 7 1 2

Relationship to Account Holder:

Type of Service:

Spouse

Child Care

„

Signature of Provider:

$

Type of Service

Qualifying Child

Preschool

1 1 5 0 0

,

.

(Replaces the need for other proof of service.)

Qualifying Relative

Before/After school

Other __________________

Senior day care

Martha Sunshine

…

Amount Billed

Au pair

Summer day camp

†

0 1 0 3 1 2

Jacob Smith

Provider Signature is not required, but can

Dependent Name: ______________________________________________________

Debbie's Daycare

0 1 0 7 1 2

Relationship to Account Holder:

Type of Service:

replace need for other proof of service.

Spouse

Child Care

Signature of Provider:

$

Qualifying Child

Preschool

1 3 0 0 0

,

.

Qualifying Relative

(Replaces the need for other proof of service.)

Before/After school

Debbie Johnson

Other __________________

Senior day care

Au pair

Summer day camp

Dependent Name: ______________________________________________________

Type of Service:

Relationship to Account Holder:

Child Care

Spouse

$

Signature of Provider:

Qualifying Child

Preschool

,

.

Before/After school

(Replaces the need for other proof of service.)

Qualifying Relative

Other __________________

Senior day care

Tips For Claim Submission

Au pair

Summer day camp

Dependent care expenses cannot be paid to anyone who is your child or stepchild under the age of 19 and claimed as a dependent on your

Dependent Name: ______________________________________________________

Relationship to Account Holder:

Type of Service:

tax returns.

Spouse

Child Care

$

Signature of Provider:

Preschool

Qualifying Child

,

.

Qualifying Relative

Before/After school

(Replaces the need for other proof of service.)

A dependent is defined as someone who spends at least 8 hours a day in your home and is one of the following:

Senior day care

Other __________________

Au pair

Summer day camp

• A tax dependent child under the age of 13 for whom you have custody more than half of the year.

CLAIM FORM TOTAL:

$

More expenses? Please complete another form.

,

.

• A dependent that is physically or mentally incapable of self care regardless of age.

Only submit claims for eligible expenses. Extended overnight camps, kindergarten or higher-grade tuition, non work related day care or long term

CERTIFICATION AND AUTHORIZATION:

I certify that the information on this page is accurate and complete. I am requesting reimbursement for work-related dependent care expenses

incurred by an eligible dependent (for a child under the age of 13 or other dependents that are physically and mentally incapable of taking care of themselves) while I was a participant in the

care services are not eligible expenses. The only expenses considered eligible are those that are incurred while you or your spouse are working,

plan. These services have already been provided and confirm that by requesting reimbursement here that I have not and will not seek reimbursement of this expense from any other plan or

party. Use of this service indicates my acceptance of the WageWorks User Agreement at (available upon registration; enter username and password or click on First Time

User? link).

looking for work or attending school full time.

WW-DC-PMB (Nov 2012)

Tips For Documentation

Ensure that the documentation is legible.

Cancelled or copies of checks and credit card receipts do not contain all 5 required pieces of information needed to approve your expense, and are

not acceptable for submission.

If multiple pieces of documentation are attached, please circle the dollar amount that is being claimed on each piece of documentation.

The use of a highlighter causes items to not be legible on the documentation; highlighter use is not recommended.

At the end of the tax year, you are required to provide the IRS with the provider name, address and Tax ID # on Tax Form 2441 in order to obtain the

tax advantage for these expenses.

Tips For Faxing

Do not use a cover page when faxing the claim form and documentation.

Please allow 2 business days from receipt of your claim for processing.

You will be notified via email of the status of your claim if we have a valid email address on file (to update your email address, please log in to your

account at and select “Profile” in the upper right corner of the screen.

Send only photocopies of your claim form and documentation – keep the originals for your records if submitting via postal mail.

Submit only claims for your own account.

WW-DC-PMB (Nov 2012)

1

1 2

2