Council Tax Exemption Application - Glasgow City Council Page 2

ADVERTISEMENT

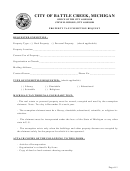

COUNCIL TAX EXEMPTION APPLICATION - SMI

NAME OF LIABLE PERSON:

SUBJECT ADDRESS:

SECTION 1 – TO BE COMPLETED BY THE APPLICANT, REPRESENTATIVE OR AGENT

I, (print name)

apply for exemption from Council Tax due on

the above property with effect from ____/____/____

The qualifying benefit(s) received by the liable person is/are (Please tick)

Short Term Incapacity Benefit

Attendance Allowance

The highest or middle rate of the care

Severe Disablement Allowance

component of Disability Living Allowance

Disabled Person's Tax Credit

Unemployability Supplement

The Daily Living component of Personal

Armed Forces Independence Payment

Independence Payment

Constant Attendance Allowance

Unemployability Allowance

Income Support where the applicable

Long Term Incapacity Benefit

amount includes a disability premium

Employment and Support Allowance

Universal Credit

These benefit(s) has/have been payable since

I enclose evidence of the above e.g. a letter from the Department for Work and Pensions confirming

entitlement to the benefit(s).

The number of adults (including the liable person) usually resident in the property is

Please note that payment of Council Tax should not be withheld pending the result of any

Exemption/Discount application.

DECLARATION

I confirm that the information on this form is correct and authorise Glasgow City Council to check the details.

If the property no longer meets the exemption requirements, I will notify The Council within 21 days.

I

understand that failure to do so is an offence, which may make me liable for a fine of £50 and £200 for each

subsequent offence.

Signed

Date ____/____/____

Print Name Here

Relationship to applicant

Please supply daytime telephone number

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3