Settlement Statement Page 3

ADVERTISEMENT

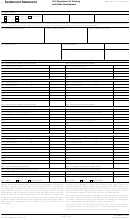

Comparison of Good Faith Estimate (GFE) and HUD-1 Charges

Good Faith Estimate

HUD-1

Charges That Cannot Increase

HUD-1 Line Number

Our origination charge

# 801

2,000.00

2,000.00

Your credit or charge (points) for the specific interest rate chosen

# 802

Your adjusted origination charges

# 803

2,000.00

2,000.00

Transfer taxes

#1203

Charges That in Total Cannot Increase More than 10%

Good Faith Estimate

HUD-1

Government recording charges

#1201

208.00

208.00

Appraisal fee

# 804

350.00

350.00

Credit report

# 805

4.66

4.66

Tax service

# 806

72.00

72.00

Flood certification

# 807

4.00

4.00

Title services and lender's title insurance

#1101

1,063.75

1,063.75

Total

1,702.41

1,702.41

Increase between GFE and HUD-1 Charges

$

0.00 or

0.00%

Charges That Can Change

Good Faith Estimate

HUD-1

Initial deposit for your escrow account

#1001

541.66

541.66

Daily interest charges

# 901

$

23.000000/day

345.00

345.00

Homeowner's insurance

# 903

1,000.00

1,000.00

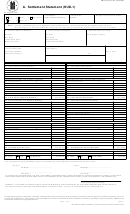

Loan Terms

$ 200,000.00

Your initial loan amount is

30 years

Your loan term is

Your initial interest rate is

4.1250 %

$ 969.30 includes

Your initial monthly amount owed for principal, interest and

any mortgage insurance is

Principal

X

Interest

X

Mortgage Insurance

X

No

Yes, it can rise to a maximum of _________%. The first

Can your interest rate rise?

change will be on ________ and can change again every ___ months after

________. Every change date, your interest rate can increase or decrease

by _________%. Over the life of the loan, your interest rate is guaranteed

to never be lower than _________% or higher than _________%.

Even if you make payments on time, can your loan balance rise?

X

No

Yes, it can rise to a maximum of $_________.

X

No

Yes, the first increase can be on ________ and the monthly

Even if you make payments on time, can your monthly

amount owed for principal, interest, and mortgage insurance rise?

amount owed can rise to $_________.

The maximum it can ever rise to is $_________.

Yes, your maximum prepayment penalty is $_________.

Does your loan have a prepayment penalty?

X

No

Does your loan have a balloon payment?

Yes, you have a balloon payment of $_________

X

No

due in ___ years on ________.

Total monthly amount owed including escrow account payments

You do not have a monthly escrow payment for items, such as property

taxes and homeowner's insurance. You must pay these items directly

yourself.

X

You have an additional monthly escrow payment of $458.33 that results

in a total initial monthly amount owed of $1,427.63. This includes

principal, interest, any mortgage insurance and any items checked below:

X

Property taxes

X

Homeowner's insurance

Flood insurance

Note: If you have any questions about the Settlement Charges and Loan Terms listed on this form, please contact your lender.

Page 3 of 3

HUD-1

(RICKMCPHERSONEXAMPLE.PFD/RICKMCPHERSONEXAMPLE/26)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4 5

5