Settlement Statement Page 3

ADVERTISEMENT

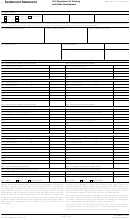

Comparison of Good Faith Estimate (GFE) and HUD-1 Charges

Charges That Cannot Increase

HUD-1 Line Number

Good Faith Estimate

HUD-1

Our origination charge

# 801

Your credit or charge (points) for the specific interest rate chosen

# 802

Your adjusted origination charges

# 803

Transfer taxes

# 1203

Charges That in Total Cannot Increase More Than 10%

HUD-1 Line Number

Good Faith Estimate

HUD-1

Government recording charges

# 1201

Appraisal Fee

# 804

Credit Report

# 805

Tax Service Fee

# 806

Flood Certification

# 807

Mortgage Insurance

# 902

#

#

#

#

Total

Increase between GFE and HUD-1 Charges

$0.00

Charges That Can Change

HUD-1 Line Number

Good Faith Estimate

HUD-1

Initial deposit for your escrow account

# 1001

Daily Interest charges

# 901

/day

Homeowner's Insurance

# 903

Title Services including Lender Title Insurance

# 1101

Owners Title Insurance

# 1103

#

#

Loan Terms

Your initial loan amount is

Your loan term is

years

Your initial interest rate is

%

Your initial monthly amount owed for principal, interest, and

includes

Interest

any mortgage insurance is

Principal

Mortgage Insurance

Can your interest rate rise?

No

Yes, it can rise to a maximum of _____%. The first change will be

on ____ (date) and can change again every ____ months after

____ (date). Every change date, your interest rate can increase or

decrease by ____%. Over the life of the loan, your interest rate is

guaranteed to never be lower than ___% or higher than ___%.

Even if you make payments on time, can your loan balance rise?

No

Yes, it can rise to a maximum of $

Even if you make payments on time, can your monthly

No

Yes, the first increase can be on ______ and the monthly amount

amount owed for principal, interest, and mortgage insurance rise?

owed can rise to $___. The maximum it can ever rise to is $____

Does your loan have a prepayment penalty?

No

Yes, your maximum prepayment penalty is $

Does your loan have a balloon payment?

No

Yes, you have a balloon payment of $___ due in ___ years on ____,

Total monthly amount owed including escrow account payments

You do not have a monthly escrow payment for items, such as property taxes and

homeowner's insurance. You must pay these items directly yourself.

You do have an additional monthly escrow payment as shown below that results

in a total initial monthly amount owed as shown below. This includes principal,

interest, any mortgage insurance and any items checked below:

Total Mortgage Payment

Escrow Amount

Homeowners Insurance

Property Tax

Flood Insurance

Ground Rent

Note: If you have any questions about the Settlement Charges and Loan Terms listed on this form, please contact your lender.

Previous editions are obsolete

Page 3

HUD-1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4