A

D

R

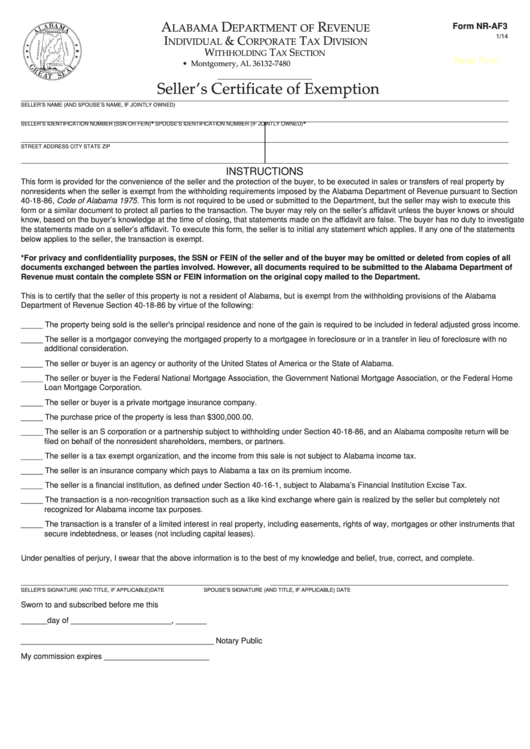

Form NR-AF3

LABAMA

EPARTMENT OF

EVENUE

1/14

I

& C

T

D

NDIVIDUAL

ORPORATE

AX

IVISION

W

T

S

ITHHOLDING

AX

ECTION

Reset Form

P.O. Box 327480 • Montgomery, AL 36132-7480

Seller’s Certificate of Exemption

SELLER’S NAME (AND SPOUSE’S NAME, IF JOINTLY OWNED)

*

*

SELLER’S IDENTIFICATION NUMBER (SSN OR FEIN)

SPOUSE’S IDENTIFICATION NUMBER (IF JOINTLY OWNED)

STREET ADDRESS

CITY

STATE

ZIP

INSTRUCTIONS

This form is provided for the convenience of the seller and the protection of the buyer, to be executed in sales or transfers of real property by

nonresidents when the seller is exempt from the withholding requirements imposed by the Alabama Department of Revenue pursuant to Section

40-18-86, Code of Alabama 1975. This form is not required to be used or submitted to the Department, but the seller may wish to execute this

form or a similar document to protect all parties to the transaction. The buyer may rely on the seller’s affidavit unless the buyer knows or should

know, based on the buyer’s knowledge at the time of closing, that statements made on the affidavit are false. The buyer has no duty to investigate

the statements made on a seller’s affidavit. To execute this form, the seller is to initial any statement which applies. If any one of the statements

below applies to the seller, the transaction is exempt.

*For privacy and confidentiality purposes, the SSN or FEIN of the seller and of the buyer may be omitted or deleted from copies of all

documents exchanged between the parties involved. However, all documents required to be submitted to the Alabama Department of

Revenue must contain the complete SSN or FEIN information on the original copy mailed to the Department.

This is to certify that the seller of this property is not a resident of Alabama, but is exempt from the withholding provisions of the Alabama

Department of Revenue Section 40-18-86 by virtue of the following:

_____ The property being sold is the seller's principal residence and none of the gain is required to be included in federal adjusted gross income.

_____ The seller is a mortgagor conveying the mortgaged property to a mortgagee in foreclosure or in a transfer in lieu of foreclosure with no

additional consideration.

_____ The seller or buyer is an agency or authority of the United States of America or the State of Alabama.

_____ The seller or buyer is the Federal National Mortgage Association, the Government National Mortgage Association, or the Federal Home

Loan Mortgage Corporation.

_____ The seller or buyer is a private mortgage insurance company.

_____ The purchase price of the property is less than $300,000.00.

_____ The seller is an S corporation or a partnership subject to withholding under Section 40-18-86, and an Alabama composite return will be

filed on behalf of the nonresident shareholders, members, or partners.

_____ The seller is a tax exempt organization, and the income from this sale is not subject to Alabama income tax.

_____ The seller is an insurance company which pays to Alabama a tax on its premium income.

_____ The seller is a financial institution, as defined under Section 40-16-1, subject to Alabama’s Financial Institution Excise Tax.

_____ The transaction is a non-recognition transaction such as a like kind exchange where gain is realized by the seller but completely not

recognized for Alabama income tax purposes.

_____ The transaction is a transfer of a limited interest in real property, including easements, rights of way, mortgages or other instruments that

secure indebtedness, or leases (not including capital leases).

Under penalties of perjury, I swear that the above information is to the best of my knowledge and belief, true, correct, and complete.

SELLER’S SIGNATURE (AND TITLE, IF APPLICABLE)

DATE

SPOUSE’S SIGNATURE (AND TITLE, IF APPLICABLE)

DATE

Sworn to and subscribed before me this

______day of _______________________, _______

____________________________________________ Notary Public

My commission expires ________________________

1

1