Form 886-H-Dep-2012 Supporting Documents For Dependency Exemptions

ADVERTISEMENT

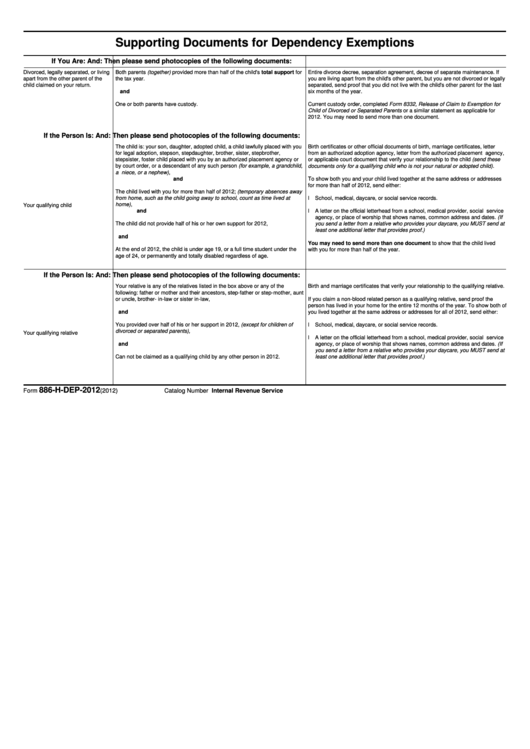

Supporting Documents for Dependency Exemptions

If You Are:

And:

Then please send photocopies of the following documents:

Divorced, legally separated, or living

Both parents (together) provided more than half of the child's total support for

Entire divorce decree, separation agreement, decree of separate maintenance. If

apart from the other parent of the

the tax year.

you are living apart from the child's other parent, but you are not divorced or legally

child claimed on your return.

separated, send proof that you did not live with the child's other parent for the last

and

six months of the year.

One or both parents have custody.

Current custody order, completed Form 8332, Release of Claim to Exemption for

Child of Divorced or Separated Parents or a similar statement as applicable for

2012. You may need to send more than one document.

If the Person Is:

And:

Then please send photocopies of the following documents:

The child is: your son, daughter, adopted child, a child lawfully placed with you

Birth certificates or other official documents of birth, marriage certificates, letter

for legal adoption, stepson, stepdaughter, brother, sister, stepbrother,

from an authorized adoption agency, letter from the authorized placement agency,

stepsister, foster child placed with you by an authorized placement agency or

or applicable court document that verify your relationship to the child (send these

by court order, or a descendant of any such person (for example, a grandchild,

documents only for a qualifying child who is not your natural or adopted child).

a niece, or a nephew),

and

To show both you and your child lived together at the same address or addresses

for more than half of 2012, send either:

The child lived with you for more than half of 2012; (temporary absences away

l School, medical, daycare, or social service records.

from home, such as the child going away to school, count as time lived at

home),

Your qualifying child

l A letter on the official letterhead from a school, medical provider, social service

and

agency, or place of worship that shows names, common address and dates. (If

The child did not provide half of his or her own support for 2012,

you send a letter from a relative who provides your daycare, you MUST send at

least one additional letter that provides proof.)

and

You may need to send more than one document to show that the child lived

At the end of 2012, the child is under age 19, or a full time student under the

with you for more than half of the year.

age of 24, or permanently and totally disabled regardless of age.

If the Person Is:

And:

Then please send photocopies of the following documents:

Your relative is any of the relatives listed in the box above or any of the

Birth and marriage certificates that verify your relationship to the qualifying relative.

following: father or mother and their ancestors, step-father or step-mother, aunt

or uncle, brother- in-law or sister in-law,

If you claim a non-blood related person as a qualifying relative, send proof the

person has lived in your home for the entire 12 months of the year. To show both of

and

you lived together at the same address or addresses for all of 2012, send either:

l School, medical, daycare, or social service records.

You provided over half of his or her support in 2012, (except for children of

divorced or separated parents),

Your qualifying relative

l A letter on the official letterhead from a school, medical provider, social service

and

agency, or place of worship that shows names, common address and dates. (If

you send a letter from a relative who provides your daycare, you MUST send at

Can not be claimed as a qualifying child by any other person in 2012.

least one additional letter that provides proof.)

886-H-DEP-2012

Form

(2012)

Catalog Number 60517C

Department of the Treasury - Internal Revenue Service

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2