Form Pit-S - New Mexico Supplemental Schedule For Dependent Exemptions In Excess Of Five - 2014

ADVERTISEMENT

*140260200*

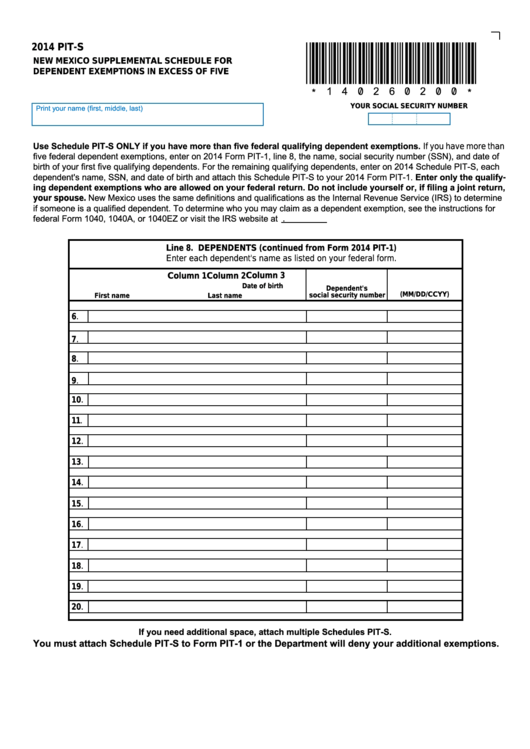

2014 PIT-S

NEW MEXICO SUPPLEMENTAL SCHEDULE FOR

DEPENDENT EXEMPTIONS IN EXCESS OF FIVE

YOUR SOCIAL SECURITY NUMBER

Print your name (first, middle, last)

Use Schedule PIT-S ONLY if you have more than five federal qualifying dependent exemptions. If you have more than

five federal dependent exemptions, enter on 2014 Form PIT-1, line 8, the name, social security number (SSN), and date of

birth of your first five qualifying dependents. For the remaining qualifying dependents, enter on 2014 Schedule PIT-S, each

dependent's name, SSN, and date of birth and attach this Schedule PIT-S to your 2014 Form PIT-1. Enter only the qualify-

ing dependent exemptions who are allowed on your federal return. Do not include yourself or, if filing a joint return,

your spouse. New Mexico uses the same definitions and qualifications as the Internal Revenue Service (IRS) to determine

if someone is a qualified dependent. To determine who you may claim as a dependent exemption, see the instructions for

federal Form 1040, 1040A, or 1040EZ or visit the IRS website at

Line 8. DEPENDENTS (continued from Form 2014 PIT-1)

Enter each dependent's name as listed on your federal form.

Column 3

Column 1

Column 2

Date of birth

Dependent's

(MM/DD/CCYY)

social security number

First name

Last name

6.

7.

8.

9.

10.

11.

12.

13.

14.

15.

16.

17

.

18.

19.

20.

If you need additional space, attach multiple Schedules PIT-S.

You must attach Schedule PIT-S to Form PIT-1 or the Department will deny your additional exemptions.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1