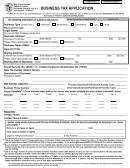

Business Tax Application - City Of Orlando Page 2

ADVERTISEMENT

Business Tax Application—Page 2

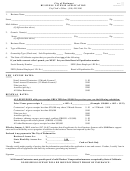

Business Tax Declaration

Section II Variable Information

Please complete the following variable information table for the applicable fiscal years. If you need any

assistance in determining which variables apply to your business, please call 407.246.2204. When you have

completed this section, please sign the certification and return with the Business Tax Receipt Application.

st

th

Information Period runs from Oct. 1

to Sep. 30

Average Annual

Square Footage

# of Workers

# of Professionals

# of Units

Inventory

2009 – 2010

$

2010 – 2011

$

2011 - 2012

$

2012 - 2013

$

2013 - 2014

$

2014 – 2015

$

2015 - 2016

$

Section III Certification

I certify under the penalty of perjury that the information in Section I is accurate and correct to the best of my

knowledge and belief. I understand that if any portion is false or misrepresented such fact may constitute a

criminal violation of the City Code Section 43.16 and may be just cause for revocation of any Business Tax

Receipt issued. Further, I warrant that I am duly authorized to enter into and execute this Business Tax

Application on behalf of my business/firm.

I further understand that the issuance of a Business Tax Receipt is a privilege to conduct business in the City

of Orlando, and that failure to correct conditions on the premises which are in violation of the City Code is

punishable under Section 1.08 of the Code of the City of Orlando and such failure may be just cause for

immediate revocation of any Business Tax Receipt issued.

Signature of person authorized to sign for firm

Print Title

Phone Number

______________________________

_

Print Name

Date

Rev 10/15

OFFICE OF PERMITTING SERVICES

CITY HALL 400 SOUTH ORANGE AVENUE FIRST FLOOR P.O. BOX 4990 ORLANDO, FLORIDA 32802-4990

PHONE 407.246.2204 FAX 407.246.3420

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4