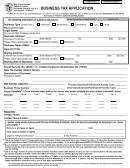

Business Tax Application - City Of Orlando Page 4

ADVERTISEMENT

Business Tax Receipt Application—Page 4

Business Tax Receipt Information

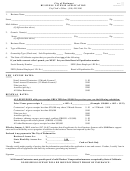

Renewals:

th

st

All Business Tax Receipts expire September 30

. Invoices are mailed July 1

and are due no later than

st

October 1

. Each business is given an option of paying later with a delinquency penalty. In October, the

penalty is 10% of the Business Tax Receipt fee; November, 15%; December, 20%; or January, 25%. After

st

February 1

an additional late-payment penalty of $250 will be applied to any unpaid Business Tax Receipt

renewal. Failure to receive an invoice is not an excuse for nonpayment.

Changes:

Certain businesses whose Business Tax Receipt tax is based on some type of variable such as number of

workers, or dollar value of inventory have to complete a Business Tax Declaration form annually. Each April,

the business will be mailed a Declaration Form. It must be completed and returned to the City no later than

st

st

June 1

. Failure to return the Business Tax Declaration form by June 1

will result in a 25% penalty.

This penalty will be added to next year’s Business Tax Receipt fees. This penalty is in addition to any

delinquent or late-payment penalties.

Business Tax Receipts may be transferred in two ways:

1. To a new owner when there is a sale of the business; please submit the original Business Tax Receipt and

evidence of the sale with a transfer fee of ten percent (10%) of the Business Tax Receipt fee (excluding

administrative fee and penalties) but not less than $3.00 or more than $25.00.

2. To a new location within the City of Orlando; please submit the original Business Tax Receipt and

evidence of the change in location with a transfer fee of ten percent (10%) of the Business Tax Receipt fee

(excluding administrative fee and penalties) but not less than $3.00 or more than $25.00.

Proration:

st

st

Business Tax Receipt fees for businesses starting on or after January1

and before August 1

are reduced

based on the month the business starts, as follows: Jan.: 10%

Feb.: 20%

March: 30%

April: 40%

May: 50%

June: 60%

July: 70%. This is in addition to a $20.00 application fee and any penalties that may

st

shall pay next year’s fee and be issued next year’s Business

apply. Businesses starting on or after August 1

th

Tax Receipt. Prorated Business Tax Receipts are nonrefundable and expire September 30

.

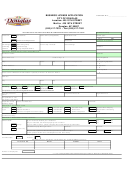

Inspection Information:

Often a prospective business site has deficiencies which must be corrected in order to meet city, county or

state requirements. The general nature of the improvements that may be required include building structures,

electrical wiring, plumbing, doorways, fire protection, drainage, sidewalk, sanitation, food handling, parking

areas, landscaping, sign revisions, traffic hazards, and other items related to your specific business.

Below is a list of agencies and their phone numbers that should be checked concerning code requirements or

regulations before starting a business operation at any location.

City of Orlando

Professional Regulation

850.487.1395

Business Tax Receipt

407.246.2204

Workers Compensation

850.413.1601

Customer Service

407.246.2271

Hotels & Restaurants

850.487.1395

Code Enforcement

407.246.2686

Alcoholic Beverage

407.245.0785

Orange County

Agriculture (Food Safety)

800.435.7352

Business Tax

407.836.5650

Sellers of Travel

800.435.7352

State Agencies

Motor Vehicle Repair

800.435.7352

Divisions of Corporations

850.245.6052

Revenue (Sales Tax)

407.475.1200

Fictitious Name

Federal Employers Identification

Registration

850.245.6058

800.829.3676

Number (FEIN)

( )

Rev. 10/29/13

OFFICE OF PERMITTING SERVICES

CITY HALL 400 SOUTH ORANGE AVENUE FIRST FLOOR P.O. BOX 4990 ORLANDO, FLORIDA 32802-4990

PHONE 407.246.2204 FAX 407.246.3420

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4