Form 1084 (2015) - Cash Flow Analysis Template

ADVERTISEMENT

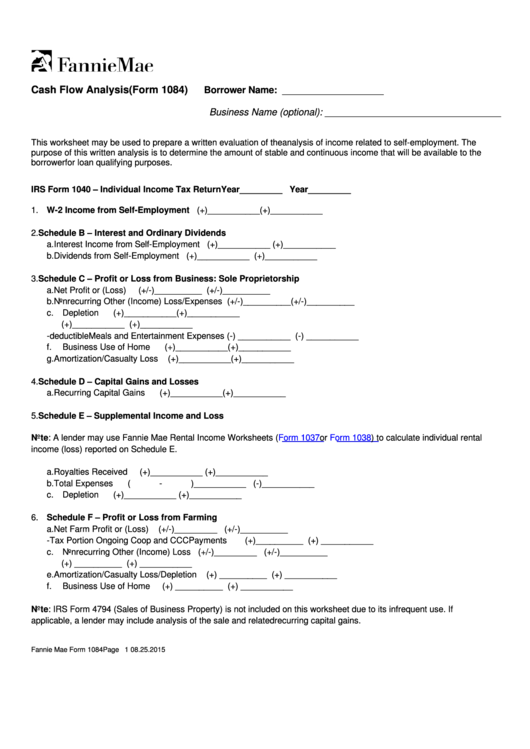

Cash Flow Analysis (Form 1084)

Borrower Name: ___________________

Business Name (optional): _________________________________

This worksheet may be used to prepare a written evaluation of the analysis of income related to self-employment. The

purpose of this written analysis is to determine the amount of stable and continuous income that will be available to the

borrower for loan qualifying purposes.

IRS Form 1040 – Individual Income Tax Return

Year_________

Year_________

1. W-2 Income from Self-Employment

(+)___________

(+)___________

2. Schedule B – Interest and Ordinary Dividends

a. Interest Income from Self-Employment

(+)___________

(+)___________

b. Dividends from Self-Employment

(+)___________

(+)___________

3. Schedule C – Profit or Loss from Business: Sole Proprietorship

a. Net Profit or (Loss)

(+/-)__________

(+/-)__________

b. Nonrecurring Other (Income) Loss/Expenses

(+/-)__________

(+/-)__________

c. Depletion

(+)___________

(+)___________

d. Depreciation

(+)___________

(+)___________

e. Non-deductible Meals and Entertainment Expenses

(-) ___________

(-) ___________

f.

Business Use of Home

(+)___________

(+)___________

g. Amortization/Casualty Loss

(+)___________

(+)___________

4. Schedule D – Capital Gains and Losses

a. Recurring Capital Gains

(+)___________

(+)___________

5. Schedule E – Supplemental Income and Loss

Note: A lender may use Fannie Mae Rental Income Worksheets

(Form 1037

or

Form

1038) to calculate individual rental

income (loss) reported on Schedule E.

a. Royalties Received

(+)___________

(+)___________

b. Total Expenses

(-)___________

(-)___________

c. Depletion

(+)___________

(+)___________

6. Schedule F – Profit or Loss from Farming

a. Net Farm Profit or (Loss)

(+/-)_________

(+/-)__________

b. Non-Tax Portion Ongoing Coop and CCC Payments

(+ )__________

(+) ___________

c. Nonrecurring Other (Income) Loss

(+/-)_________

(+/-)__________

d. Depreciation

(+) __________

(+) ___________

e. Amortization/Casualty Loss/Depletion

(+) __________

(+) ___________

f.

Business Use of Home

(+) __________

(+) ___________

Note: IRS Form 4794 (Sales of Business Property) is not included on this worksheet due to its infrequent use. If

applicable, a lender may include analysis of the sale and related recurring capital gains.

Fannie Mae Form 1084

Page 1

08.25.2015

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8