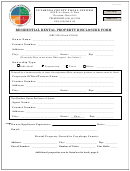

OWNER INFORMATION REQUIREMENTS FOR RESIDENTIAL RENTAL PROPERTY

INFORMATION TO BE FILED WITH THE COUNTY FISCAL OFFICE

INFORMATION TO BE FILED WITH THE COUNTY AUDITOR

(R.C. 5323.02 and 5323.99)

The act requires an owner of "residential rental property" to file certain information with the County Fiscal Office of the county in which the property is located. The act defines

"residential rental property" as real property on which is located one or more dwelling units leased or otherwise rented to tenants solely for residential purposes, or a

mobile home park or other permanent or semipermanent site at which lots are leased or otherwise rented to tenants for the parking of a manufactured home, mobile

home, or recreational vehicle that is used solely for residential purposes, but not including a hotel or a college or university dormitory.

The information that must be filed with the County Fiscal Officer is as follows:

(1) The owner's name, address, and telephone number;

(2) If the residential rental property is owned by a trust, business trust, estate, partnership, limited partnership, limited liability company, association, corporation, or any

other business entity: the name, address, and telephone number of the trustee, in the case of a trust or business trust; the executor or administrator, in the case of an

estate; a general partner, in the case of a partnership or a limited partnership; a member, manager, or officer, in the case of a limited liability company; an associate, in

the case of an association; an officer, in the case of a corporation; and a member, manager, or officer, in the case of any other business entity.

(3) The street address and permanent parcel number of the residential rental property;

(4) If the residential rental property has dwelling units that are leased or otherwise rented to tenants, the year the units were built.

This information must be filed and maintained in a manner to be determined by the County Fiscal Office. The owner of residential rental property must update the information

within ten days after any change in the information occurs.

An owner that fails to comply with these information filing and updating requirements is guilty of a minor misdemeanor, which carries a fine of not more than $150 or a

term of community service of up to 30 hours in lieu of or as part of the fine.

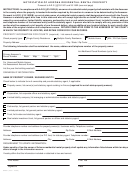

REQUIREMENT FOR NONRESIDENT OWNERS

(R.C. 5323.03 and 5323.99)

The act provides that an owner of residential rental property who resides outside of Ohio must designate, in a manner to be determined by the county auditor of the

county in which the property is located, an individual who resides in Ohio to serve as the owner's agent for the acceptance of service of process on behalf of the owner in

any legal action or proceeding in Ohio, unless the owner previously designated and continues to maintain a statutory agent for the service of process with the Secretary

of State as a condition of being authorized to engage in business in Ohio pursuant to another Ohio law.

A nonresident owner who designates an agent must file in writing with the relevant County Fiscal Office the name, address, and telephone number of the agent. An owner who

previously designated and continues to maintain a statutory agent for the service of process with the Secretary of State as a condition of being authorized to engage in

business in Ohio pursuant to another Ohio law is required to file in writing with the county auditor of the county in which the residential rental property is located a certified

copy of the document filed with the Secretary of State that contains that designation.

An owner of residential rental property that fails to satisfy the designation of agent requirement or the requirement to file a copy of the document that designates a

statutory agent is guilty of a minor misdemeanor, which carries a fine of not more than $150 or a term of community service of up to 30 hours in lieu of or as part of the

fine.

Information filed is public record

(R.C. 5323.04)

All information filed with a county auditor under the act's information requirements and statutory agent designation requirement is a public record under the Ohio Public

Records Act (R.C. 149.43).

An owner of residential rental property who complies with the act's requirements is deemed to be in full compliance with any request by the state or any political

subdivision to that owner for information that is identical to the information filed with the County Fiscal Office under the act.

1

1 2

2