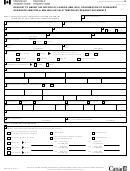

Personal Effects Accounting Document (Settler, Former Resident, Seasonal Resident, Or Beneficiary) Page 2

ADVERTISEMENT

Tariff Item No. 9807.00.00 (Settler)

Tariff Item No. 9805.00.00 (Former Resident)

Goods imported by a member of the Canadian Forces, an employee of the Canadian

Goods imported by a settler for the settler’s household or personal use, if actually

government, or by a former resident of Canada returning to Canada to resume

owned, possessed and used abroad by the settler prior to the settler’s arrival in

residence in Canada after having been a resident of another country for a period of not

Canada and accompanying the settler at the time of the settler’s arrival in Canada.

less than one year, or by a resident returning after an absence from Canada of not

less than one year, and acquired by that person for personal or household use and

For the purpose of this tariff item:

actually owned, possessed and used abroad by that person for at least six months

(a)

"goods" may include:

prior to that person’s return to Canada and accompanying that person at the time of

(i)

either wine not exceeding 1.5 litres or any alcoholic beverages not exceeding

their return to Canada.

1.14 litres, and

"Goods" does not include goods that are sold or otherwise disposed of within twelve

(ii)

tobacco not exceeding fifty cigars, two hundred cigarettes, two hundred

months after importation.

tobacco sticks and two hundred grams of manufactured tobacco;

For the purpose of this tariff item:

(b)

"goods" does not include imported goods that are sold or otherwise disposed of

(a)

the provisions shall apply to either wine not exceeding 1.5 litres or any alcoholic

within twelve months after importation; and

beverages not exceeding 1.14 litres and tobacco not exceeding fifty cigars, two

hundred cigarettes, two hundred tobacco sticks and two hundred grams of

(c)

if goods (other than alcoholic beverages, cigars, cigarettes, tobacco sticks and

manufactured tobacco if they are included in the baggage accompanying the

manufactured tobacco) are not accompanying the settler at the time of the

importer, and no relief from payment of duties is being claimed in respect of

settler’s arrival in Canada, they may be classified under this tariff item when

alcoholic beverages or tobacco under another item in this Chapter at the time of

imported at a later time if they are reported by the settler at the time of the

importation;

settler’s arrival in Canada.

(b)

if goods (other than alcoholic beverages, cigars, cigarettes, tobacco sticks and

Short Title

manufactured tobacco) are not accompanying the person returning from abroad,

they may be classified under this item when imported at a later time if they are

1.

This Order may be cited as the Tariff Item No. 9807.00.00 Exemption Order.

reported by the person at the time of return to Canada; and

Interpretation

(c)

any article which was acquired after March 31, 1977 by a class of persons named

in this tariff item and which has a value for duty as determined under the

2.

The following goods are exempt from the use requirements specified in tariff item

Customs Act of more than $10,000 shall not be classified under this tariff item.

No. 9807.00.00 of the List of Tariff Provisions set out in the Schedule to the

Customs Tariff :

Section 84 of the Customs Tariff reads:

(a)

alcoholic beverages imported by a settler who has attained the minimum age

at which a person may lawfully purchase alcoholic beverages in the province in

84. Goods that, but for the fact that their value for duty as determined under

which the customs office where the alcoholic beverages are imported is

section 46 of the Customs Act exceeds the value specified under tariff item No.

situated;

9805.00.00, would be classified under that tariff item, shall be classified under

Chapters 1 to 97 and their value for duty reduced by that specified value.

(b)

tobacco products;

Short Title

(c)

household goods acquired by a settler and set aside for use in the household

of the settler whose marriage occurred within three months before the settler’s

1.

This order may be cited as the Tariff Item No. 9805.00.00 Exemption Order.

arrival in Canada or is to occur within three months after the settler’s arrival in

Canada; and

Interpretation

2.

In this Order,

(d)

wedding gifts received outside Canada by a settler in consideration of the

settler’s marriage which occurred within three months before the settler’s

"bride’s trousseau" means goods acquired for use in the household of a newly married

arrival in Canada or is to occur within three months after the settler’s arrival in

couple, but does not include vehicles, vessels or aircraft;

Canada.

"wedding presents" means goods of a non-commercial nature received by a person as

Tariff Item No. 9829.00.00 (Seasonal Resident)

personal gifts in consideration of that person’s recent marriage or the anticipated

marriage of that person within three months of the person’s return to Canada.

Household furniture and furnishings for a seasonal residence, excluding construction

materials, electrical fixtures or other goods permanently attached to or incorporated

Exemption

into a seasonal residence;

3.

The following goods are exempt from the six-month ownership, possession or use

requirements set out in tariff item No. 9805.00.00 of the Customs Tariff

Tools and equipment for the maintenance of a seasonal residence;

The foregoing, on condition that:

(a)

alcoholic beverages owned by, in the possession of and imported by a person

who has attained the minimum age at which a person may lawfully purchase

alcoholic beverages in the province in which the customs office where the

(i)

the goods are imported by a person who is not a resident of Canada and who

alcoholic beverages are imported is situated;

owns or leases for not less than three years a residence in Canada for

seasonal use, other than a time-sharing residence, trailer or mobile home;

(b)

tobacco products owned by and in the possession of the importer;

(ii)

the person is entitled to only one importation under this tariff item;

(c)

a bride’s trousseau owned by, in the possession of and imported by a recently

married person or a bride-to-be whose anticipated marriage is to take place

within three months of the date of her return to Canada;

(iii)

the goods are for the personal use of that person or their family and are not

for any commercial, industrial or occupational purpose;

(d)

wedding presents owned by, in the possession of, and imported by the

recipient thereof;

(iv)

the goods are owned, possessed and used by that person or their family

before their first arrival in Canada to occupy the seasonal residence;

(e)

any goods imported by a person who has resided abroad for at least five

years immediately prior to returning to Canada and who, prior to the date of

(v)

the goods are not sold or otherwise disposed of in Canada for at least one

return, owned, was in possession of and used the goods; and

year after the date of their importation; and

(f)

goods acquired as replacements for goods that, but for their loss or

(vi)

the goods accompany the seasonal resident at the time of the seasonal

destruction as the result of fire, theft, accident or other unforeseen

resident’s first arrival in Canada to occupy the seasonal residence or, if not

contingency, would have been classified under tariff item No. 9805.00.00 of

imported at the time of first arrival in Canada, are, at that time, described and

the Customs Tariff , on condition that

listed on a customs accounting document as goods to follow.

(i)

the goods acquired as replacements are of a similar class and

approximately of the same value as the goods they replaced,

NOTE FOR FORMER RESIDENTS AND SETTLERS TO CANADA (TARIFF ITEM

NO. 9805.00.00 AND 9807.00.00)

(ii)

the goods acquired as replacements were owned by, in the possession of,

and used by a person prior to the person’s return to Canada, and

Effective October 1, 2001, a new duty applies to cigarettes, tobacco sticks, and

manufactured tobacco that you include in your personal exemption entitlement.

(iii)

evidence is produced at the time the goods are accounted for under

However, this duty does not apply if the product is marked "Canada Duty Paid".

section 32 of the Customs Act that the goods they replaced were lost or

destroyed as the result of fire, theft, accident or other unforeseen

Please refer to Section 21 of the Customs Tariff for legislative references.

contingency.

Tariff Item No. 9806.00.00 (Beneficiary)

Personal and household effects of a resident of Canada who has died, on the condition

that such goods were owned, possessed and used abroad by that resident;

Personal and household effects received by a resident of Canada as a result of the

death or in anticipation of death of a person who is not a resident of Canada, on

condition that such goods were owned, possessed and used abroad by that

non-resident;

All the foregoing when bequeathed to a resident of Canada.

Printed in Canada

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2