Reset Form

Print Form

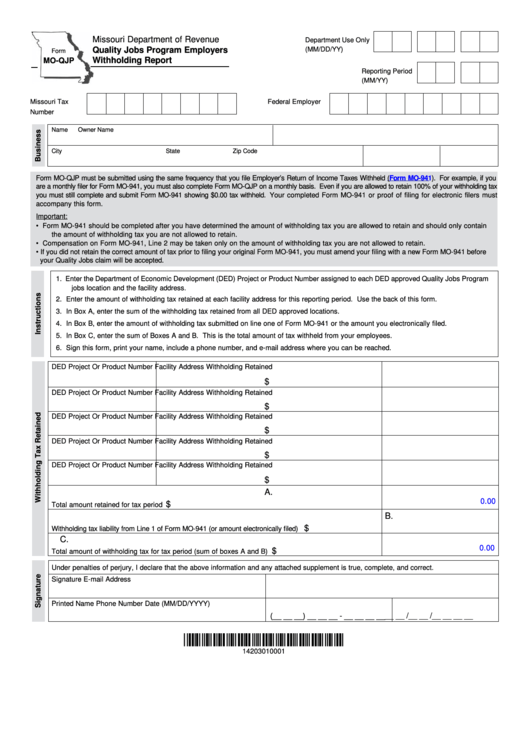

Missouri Department of Revenue

Department Use Only

Quality Jobs Program Employers

(MM/DD/YY)

Form

Withholding Report

MO-QJP

Reporting Period

(MM/YY)

Missouri Tax I.D.

Federal Employer

Number

I.D. Number

Name

Owner Name

City

State

Zip Code

Form MO-QJP must be submitted using the same frequency that you file Employer’s Return of Income Taxes Withheld

(Form

MO-941). For example, if you

are a monthly filer for Form MO-941, you must also complete Form MO-QJP on a monthly basis. Even if you are allowed to retain 100% of your withholding tax

you must still complete and submit Form MO-941 showing $0.00 tax withheld. Your completed Form MO-941 or proof of filing for electronic filers must

accompany this form.

Important:

•

Form MO-941 should be completed after you have determined the amount of withholding tax you are allowed to retain and should only contain

the amount of withholding tax you are not allowed to retain.

•

Compensation on Form MO-941, Line 2 may be taken only on the amount of withholding tax you are not allowed to retain.

•

If you did not retain the correct amount of tax prior to filing your original Form MO-941, you must amend your filing with a new Form MO-941 before

your Quality Jobs claim will be accepted.

1.

Enter the Department of Economic Development (DED) Project or Product Number assigned to each DED approved Quality Jobs Program

jobs location and the facility address.

2.

Enter the amount of withholding tax retained at each facility address for this reporting period. Use the back of this form.

3.

In Box A, enter the sum of the withholding tax retained from all DED approved locations.

4.

In Box B, enter the amount of withholding tax submitted on line one of Form MO-941 or the amount you electronically filed.

5.

In Box C, enter the sum of Boxes A and B. This is the total amount of tax withheld from your employees.

6.

Sign this form, print your name, include a phone number, and e-mail address where you can be reached.

DED Project Or Product Number Facility Address

Withholding Retained

$

DED Project Or Product Number Facility Address

Withholding Retained

$

DED Project Or Product Number Facility Address

Withholding Retained

$

DED Project Or Product Number Facility Address

Withholding Retained

$

DED Project Or Product Number Facility Address

Withholding Retained

$

A.

0.00

$

Total amount retained for tax period . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

B.

$

Withholding tax liability from Line 1 of Form MO-941 (or amount electronically filed) . . . . . . . . . . . . . . . . . . . . . . .

C.

0.00

$

Total amount of withholding tax for tax period (sum of boxes A and B) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Under penalties of perjury, I declare that the above information and any attached supplement is true, complete, and correct.

Signature

E-mail Address

Printed Name

Phone Number

Date (MM/DD/YYYY)

__ __ /__ __ /__ __ __ __

(__ __ __) __ __ __ - __ __ __ __

*14203010001*

14203010001

1

1 2

2