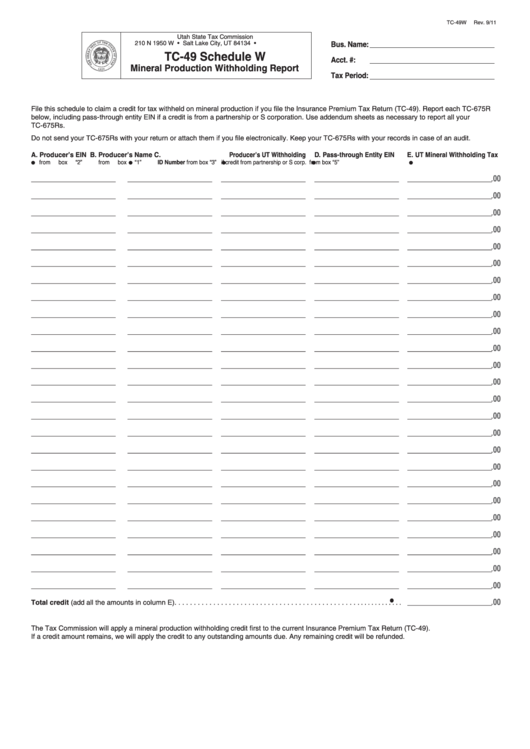

Form Tc-49 - Schedule W Mineral Production Withholding Report

ADVERTISEMENT

TC-49W

Rev. 9/11

Utah State Tax Commission

210 N 1950 W • Salt Lake City, UT 84134 • tax.utah.gov

Bus. Name:

TC-49 Schedule W

Acct. #:

Mineral Production Withholding Report

Tax Period:

File this schedule to claim a credit for tax withheld on mineral production if you file the Insurance Premium Tax Return (TC-49). Report each TC-675R

below, including pass-through entity EIN if a credit is from a partnership or S corporation. Use addendum sheets as necessary to report all your

TC-675Rs.

Do not send your TC-675Rs with your return or attach them if you file electronically. Keep your TC-675Rs with your records in case of an audit.

A. Producer’s EIN

B. Producer’s Name

C. Producer’s UT Withholding

D. Pass-through Entity EIN

E. UT Mineral Withholding Tax

from box “2”

from box “1”

ID Number from box “3”

if credit from partnership or S corp.

from box “5”

00

_ __ ____ _ __ _ _ _

_ _ _ _ __ _ _ _ __ _ _

__ _ _ _ __ _ _ _ _ _ _

_ _ _ _ _ _ _ _ _ _ _ _ _

_ _ _ _ _ _ _ __ __ _ _ .

00

_ __ ____ _ __ _ _ _

_ _ _ _ __ _ _ _ __ _ _

__ _ _ _ __ _ _ _ _ _ _

_ _ _ _ _ _ _ _ _ _ _ _ _

_ _ _ _ _ _ _ __ __ _ _ .

00

_ __ ____ _ __ _ _ _

_ _ _ _ __ _ _ _ __ _ _

__ _ _ _ __ _ _ _ _ _ _

_ _ _ _ _ _ _ _ _ _ _ _ _

_ _ _ _ _ _ _ __ __ _ _ .

00

_ __ ____ _ __ _ _ _

_ _ _ _ __ _ _ _ __ _ _

__ _ _ _ __ _ _ _ _ _ _

_ _ _ _ _ _ _ _ _ _ _ _ _

_ _ _ _ _ _ _ __ __ _ _ .

00

_ __ ____ _ __ _ _ _

_ _ _ _ __ _ _ _ __ _ _

__ _ _ _ __ _ _ _ _ _ _

_ _ _ _ _ _ _ _ _ _ _ _ _

_ _ _ _ _ _ _ __ __ _ _ .

00

_ __ ____ _ __ _ _ _

_ _ _ _ __ _ _ _ __ _ _

__ _ _ _ __ _ _ _ _ _ _

_ _ _ _ _ _ _ _ _ _ _ _ _

_ _ _ _ _ _ _ __ __ _ _ .

00

_ __ ____ _ __ _ _ _

_ _ _ _ __ _ _ _ __ _ _

__ _ _ _ __ _ _ _ _ _ _

_ _ _ _ _ _ _ _ _ _ _ _ _

_ _ _ _ _ _ _ __ __ _ _ .

00

_ __ ____ _ __ _ _ _

_ _ _ _ __ _ _ _ __ _ _

__ _ _ _ __ _ _ _ _ _ _

_ _ _ _ _ _ _ _ _ _ _ _ _

_ _ _ _ _ _ _ __ __ _ _ .

00

_ __ ____ _ __ _ _ _

_ _ _ _ __ _ _ _ __ _ _

__ _ _ _ __ _ _ _ _ _ _

_ _ _ _ _ _ _ _ _ _ _ _ _

_ _ _ _ _ _ _ __ __ _ _ .

00

_ __ ____ _ __ _ _ _

_ _ _ _ __ _ _ _ __ _ _

__ _ _ _ __ _ _ _ _ _ _

_ _ _ _ _ _ _ _ _ _ _ _ _

_ _ _ _ _ _ _ __ __ _ _ .

00

_ __ ____ _ __ _ _ _

_ _ _ _ __ _ _ _ __ _ _

__ _ _ _ __ _ _ _ _ _ _

_ _ _ _ _ _ _ _ _ _ _ _ _

_ _ _ _ _ _ _ __ __ _ _ .

00

_ __ ____ _ __ _ _ _

_ _ _ _ __ _ _ _ __ _ _

__ _ _ _ __ _ _ _ _ _ _

_ _ _ _ _ _ _ _ _ _ _ _ _

_ _ _ _ _ _ _ __ __ _ _ .

00

_ __ ____ _ __ _ _ _

_ _ _ _ __ _ _ _ __ _ _

__ _ _ _ __ _ _ _ _ _ _

_ _ _ _ _ _ _ _ _ _ _ _ _

_ _ _ _ _ _ _ __ __ _ _ .

00

_ __ ____ _ __ _ _ _

_ _ _ _ __ _ _ _ __ _ _

__ _ _ _ __ _ _ _ _ _ _

_ _ _ _ _ _ _ _ _ _ _ _ _

_ _ _ _ _ _ _ __ __ _ _ .

00

_ __ ____ _ __ _ _ _

_ _ _ _ __ _ _ _ __ _ _

__ _ _ _ __ _ _ _ _ _ _

_ _ _ _ _ _ _ _ _ _ _ _ _

_ _ _ _ _ _ _ __ __ _ _ .

00

_ __ ____ _ __ _ _ _

_ _ _ _ __ _ _ _ __ _ _

__ _ _ _ __ _ _ _ _ _ _

_ _ _ _ _ _ _ _ _ _ _ _ _

_ _ _ _ _ _ _ __ __ _ _ .

00

_ __ ____ _ __ _ _ _

_ _ _ _ __ _ _ _ __ _ _

__ _ _ _ __ _ _ _ _ _ _

_ _ _ _ _ _ _ _ _ _ _ _ _

_ _ _ _ _ _ _ __ __ _ _ .

00

_ __ ____ _ __ _ _ _

_ _ _ _ __ _ _ _ __ _ _

__ _ _ _ __ _ _ _ _ _ _

_ _ _ _ _ _ _ _ _ _ _ _ _

_ _ _ _ _ _ _ __ __ _ _ .

00

_ __ ____ _ __ _ _ _

_ _ _ _ __ _ _ _ __ _ _

__ _ _ _ __ _ _ _ _ _ _

_ _ _ _ _ _ _ _ _ _ _ _ _

_ _ _ _ _ _ _ __ __ _ _ .

00

_ __ ____ _ __ _ _ _

_ _ _ _ __ _ _ _ __ _ _

__ _ _ _ __ _ _ _ _ _ _

_ _ _ _ _ _ _ _ _ _ _ _ _

_ _ _ _ _ _ _ __ __ _ _ .

00

_ __ ____ _ __ _ _ _

_ _ _ _ __ _ _ _ __ _ _

__ _ _ _ __ _ _ _ _ _ _

_ _ _ _ _ _ _ _ _ _ _ _ _

_ _ _ _ _ _ _ __ __ _ _ .

00

_ __ ____ _ __ _ _ _

_ _ _ _ __ _ _ _ __ _ _

__ _ _ _ __ _ _ _ _ _ _

_ _ _ _ _ _ _ _ _ _ _ _ _

_ _ _ _ _ _ _ __ __ _ _ .

00

_ __ ____ _ __ _ _ _

_ _ _ _ __ _ _ _ __ _ _

__ _ _ _ __ _ _ _ _ _ _

_ _ _ _ _ _ _ _ _ _ _ _ _

_ _ _ _ _ _ _ __ __ _ _ .

00

_ __ ____ _ __ _ _ _

_ _ _ _ __ _ _ _ __ _ _

__ _ _ _ __ _ _ _ _ _ _

_ _ _ _ _ _ _ _ _ _ _ _ _

_ _ _ _ _ _ _ __ __ _ _ .

00

_ __ ____ _ __ _ _ _

_ _ _ _ __ _ _ _ __ _ _

__ _ _ _ __ _ _ _ _ _ _

_ _ _ _ _ _ _ _ _ _ _ _ _

_ _ _ _ _ _ _ __ __ _ _ .

•

00

Total credit (add all the amounts in column E) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

_ _ _ _ _ _ __ _ __ __ .

The Tax Commission will apply a mineral production withholding credit first to the current Insurance Premium Tax Return (TC-49).

If a credit amount remains, we will apply the credit to any outstanding amounts due. Any remaining credit will be refunded.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2