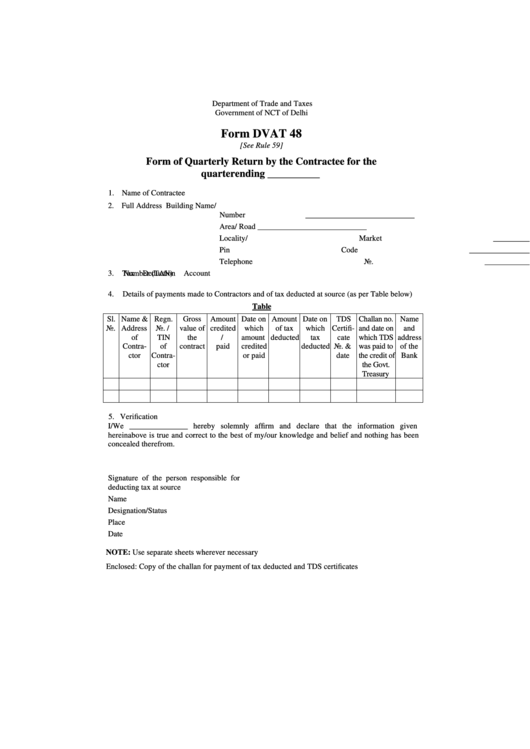

Form Dvat 48 - Form Of Quarterly Return By The Contractee

ADVERTISEMENT

Department of Trade and Taxes

Government of NCT of Delhi

Form DVAT 48

[See Rule 59]

Form of Quarterly Return by the Contractee for the

quarter ending __________

1. Name of Contractee

2. Full Address

Building Name/

Number

____________________________

Area/ Road

____________________________

Locality/ Market

____________________________

Pin Code

____________________________

Telephone No.

____________________________

3.

Tax

Deduction

Account

Number (TAN)

4.

Details of payments made to Contractors and of tax deducted at source (as per Table below)

Table

Sl.

Name &

Regn.

Gross

Amount

Date on

Amount

Date on

TDS

Challan no.

Name

No.

Address

No. /

value of

credited

which

of tax

which

Certifi-

and date on

and

of

TIN

the

/

amount

deducted

tax

cate

which TDS

address

Contra-

of

contract

paid

credited

deducted

No. &

was paid to

of the

ctor

Contra-

or paid

date

the credit of

Bank

ctor

the Govt.

Treasury

5. Verification

I/We _______________ hereby solemnly affirm and declare that the information given

hereinabove is true and correct to the best of my/our knowledge and belief and nothing has been

concealed therefrom.

Signature of the person responsible for

deducting tax at source

Name

Designation/Status

Place

Date

NOTE: Use separate sheets wherever necessary

Enclosed: Copy of the challan for payment of tax deducted and TDS certificates

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1