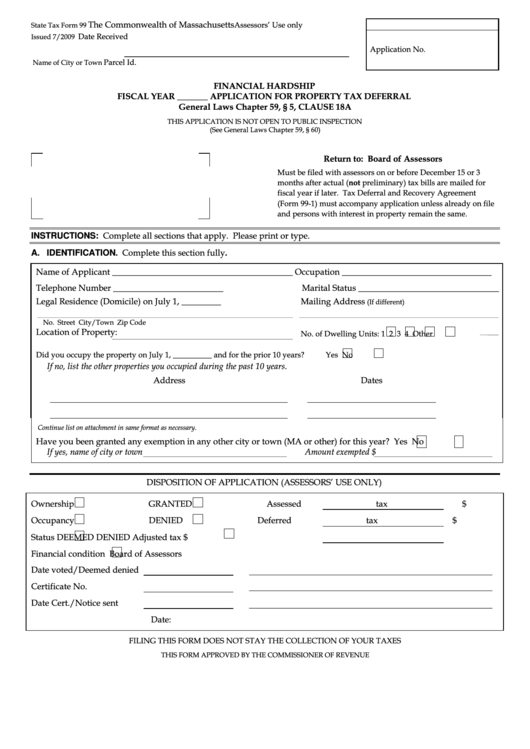

The Commonwealth of Massachusetts

Assessors’ Use only

State Tax Form 99

Date Received

Issued 7/2009

Application No.

Parcel Id.

Name of City or Town

FINANCIAL HARDSHIP

FISCAL YEAR _______ APPLICATION FOR PROPERTY TAX DEFERRAL

General Laws Chapter 59, § 5, CLAUSE 18A

THIS APPLICATION IS NOT OPEN TO PUBLIC INSPECTION

(See General Laws Chapter 59, § 60)

Return to:

Board of Assessors

Must be filed with assessors on or before December 15 or 3

months after actual (not preliminary) tax bills are mailed for

fiscal year if later. Tax Deferral and Recovery Agreement

(Form 99-1) must accompany application unless already on file

and persons with interest in property remain the same.

INSTRUCTIONS: Complete all sections that apply. Please print or type.

A. IDENTIFICATION. Complete this section fully.

Name of Applicant _________________________________________

Occupation __________________________________

Telephone Number _________________________

Marital Status ________________________________

Legal Residence (Domicile) on July 1, _________

Mailing Address

(If different)

No.

Street

City/Town

Zip Code

Location of Property:

No. of Dwelling Units: 1

2

3

4

Other

Did you occupy the property on July 1, __________ and for the prior 10 years?

Yes

No

If no, list the other properties you occupied during the past 10 years.

Address

Dates

Continue list on attachment in same format as necessary.

Have you been granted any exemption in any other city or town (MA or other) for this year? Yes

No

If yes, name of city or town

Amount exempted $

DISPOSITION OF APPLICATION (ASSESSORS’ USE ONLY)

Ownership

GRANTED

Assessed tax

$

Occupancy

DENIED

Deferred tax

$

Status

DEEMED DENIED

Adjusted tax

$

Financial condition

Board of Assessors

Date voted/Deemed denied

Certificate No.

Date Cert./Notice sent

Date:

FILING THIS FORM DOES NOT STAY THE COLLECTION OF YOUR TAXES

THIS FORM APPROVED BY THE COMMISSIONER OF REVENUE

1

1 2

2 3

3 4

4