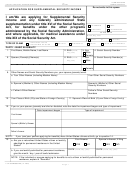

Mc 326 C Supplemental Security Income (Ssi) Income Work Sheet-Eligible Child Page 2

ADVERTISEMENT

INSTRUCTIONS

SSI METHODOLOGY: INCOME WORK SHEET FOR MC 326 C (ELIGIBLE CHILD)

There is no deeming from any parent if one or both parents is public assistance (PA), other PA, or eligible child(ren) for this

program.

PART I.

INELIGIBLE PARENT’S UNEARNED INCOME (INCLUDE STEPPARENTS)

Line

I.1. Enter the ineligible parent’s unearned income.

Line

I.2. (If no ineligible siblings, enter zero in I.2.c.) Enter the first name of any ineligible child(ren) in the

box provided. On line 2.a., enter the allocations for any ineligible child(ren) not on PA or not applying

for or eligible for this program. On line 2.b., enter any income for each of the children, excluding up to

$400 per month but no more than $1,620 per year if student income. Subtract line 2.b. from 2.a.,

enter the remainder for each child and total the allocations for all siblings on line 2.c.

Line

I.3. Subtract line I.2.c. from line I.1. (unearned income) and enter the difference. This is the remaining

unearned income amount unless the allocation amount (line I.2.c.) exceeds line I.1. (unearned

income). In the latter case, the negative figure on line I.3. is carried over to line II.2. (unused portion

of allocation).

PART II.

INELIGIBLE PARENT’S EARNED INCOME (INCLUDE STEPPARENTS)

Line II.1. Enter the parent’s earned income.

Line II.2. Enter the amount of any allocation for ineligible children that is not offset by unearned income

(line I.2.c. minus line I.1.). If line I.1. is greater than line I.2.c., enter zero in line II.2.

Line II.3. Subtract the allocation amount on line II.2. from line II.1. (gross earned income) and enter the

difference.

NOTE: If, at this point (after the allocation for ineligible children), there is no income remaining either earned or

unearned, there is no income available for deeming to the eligible child(ren). In this case, enter zero on line III.15.

and proceed to Part IV. If there is earned and/or unearned income remaining, complete both Parts III and IV.

PART III.

COMBINED INCOMES

Enter any remaining unearned income from line 1.3. on line III.1. and any remaining earned income from line II.3.

on line III.4. Follow the instructions on each line.

The entry on the last line of Part III (i.e., the “Deemed Income” line) is carried over to the first line (also titled

“Deemed Income”) on Part IV, “Eligibility Calculation.”

Do not allow deduction for other health insurance premium for ineligible parents or eligible child(ren).

PART IV.

ELIGIBILITY CALCULATION

Line IV.1. Enter the deemed income from the last line in Part III. The deemed income is treated as unearned

income.

Line IV.2. Enter the applicant’s OASDI income.

Line IV.3. Enter any other unearned income of applicant.

Line IV.4.

A. Enter the $20 any income exclusion.

Line IV.4.

B. Subtract any other unearned income deductions.

Line IV.5. Add together the amounts in lines IV.1., IV.2., and IV.3., and then subtract the $20 any income

exclusion (line IV.4.) to obtain the total countable unearned income amount.

Line IV.6.

A. Enter the applicant’s countable earned income (i.e., earned income after exclusions including the

$65 expense exclusion and 1/2 the remainder).

Line IV.6.

B. Subtract other earned income deductions (e.g., impairment-related work expenses, blind work

expenses).

Line IV.7. Add the amounts in lines IV.5. and IV.6. to obtain the total countable income.

Line IV.8.

Enter the current SSI/SSP income standard.

If line IV.7. is less than or equal to line IV.8., the child is income eligible.

MC 326 C (05/07)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2