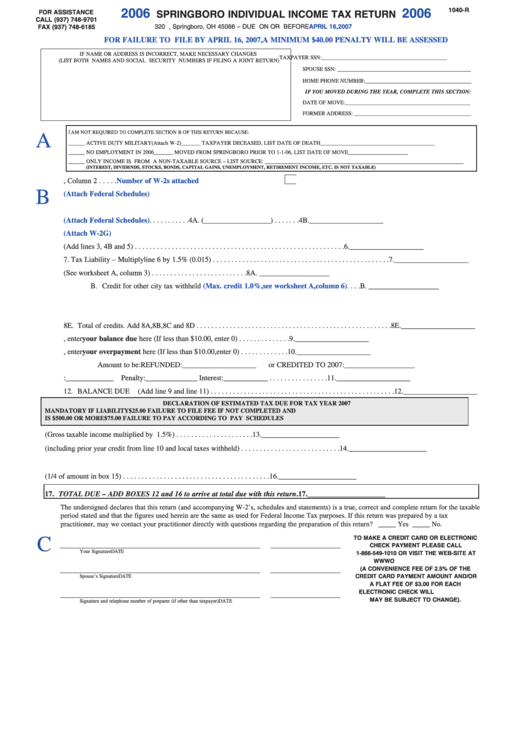

Form 1040-R - Springboro Individual Income Tax Return - 2006

ADVERTISEMENT

1040-R

2006

2006

FOR ASSISTANCE

SPRINGBORO INDIVIDUAL INCOME TAX RETURN

CALL (937) 748-9701

APRIL 16, 2007

320 W. Central Ave., Springboro, OH 45066 – DUE ON OR BEFORE

FAX (937) 748-6185

FOR FAILURE TO FILE BY APRIL 16, 2007, A MINIMUM $40.00 PENALTY WILL BE ASSESSED

IF NAME OR ADDRESS IS INCORRECT, MAKE NECESSARY CHANGES

TAXPAYER SSN: ______________________________________________

(LIST BOTH NAMES AND SOCIAL SECURITY NUMBERS IF FILING A JOINT RETURN)

SPOUSE SSN: _________________________________________________

HOME PHONE NUMBER:_______________________________________

IF YOU MOVED DURING THE YEAR, COMPLETE THIS SECTION:

DATE OF MOVE: ______________________________________________

FORMER ADDRESS: ___________________________________________

I AM NOT REQUIRED TO COMPLETE SECTION B OF THIS RETURN BECAUSE:

A

______ ACTIVE DUTY MILITARY (Attach W-2)

_______ TAXPAYER DECEASED, LIST DATE OF DEATH __________________________________________

______ NO EMPLOYMENT IN 2006

_______ MOVED FROM SPRINGBORO PRIOR TO 1-1-06, LIST DATE OF MOVE ______________________

______ ONLY INCOME IS FROM A NON-TAXABLE SOURCE – LIST SOURCE: _________________________________________________________________________

(INTEREST, DIVIDENDS, STOCKS, BONDS, CAPITAL GAINS, UNEMPLOYMENT, RETIREMENT INCOME, ETC. IS NOT TAXABLE)

.Number of W-2s attached

1.

Total from Worksheet A, Column 2 . . . .

. . . . . . . . . . . . . . . . . . . . . . . . . . . .1. ____________________

B

(Attach Federal Schedules)

2.

Total from Worksheet B

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .2. ____________________

3.

Subtract line 2 from line 1 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .3. ____________________

(Attach Federal Schedules)

4.

Total From Worksheet C

. . . . . . . . . . .4A. (__________________) . . . . . . .4B. ____________________

(Attach W-2G)

5.

Other Income

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .5. ____________________

6.

Total Income (Add lines 3, 4B and 5) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .6. ____________________

7.

Tax Liability – Multiply line 6 by 1.5% (0.015) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .7. ____________________

8.

A. Springboro tax withheld (See worksheet A, column 3) . . . . . . . . . . . . . . . . . . . . . . . . . .8A. ___________________

(Max. credit 1.0%, see worksheet A, column 6)

B. Credit for other city tax withheld

. . . .B. ___________________

C. Estimated taxes paid for 2006 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .C. ___________________

D. Prior year credit carried forward . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .D. ___________________

8E. Total of credits. Add 8A, 8B, 8C and 8D . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .8E. ____________________

If line 7 is greater than box 8E, enter your balance due here (If less than $10.00, enter 0) . . . . . . . . . . . . . .9. ____________________

9.

10. If line 8E is greater than line 7, enter your overpayment here (If less than $10.00, enter 0) . . . . . . . . . . . . .10. ____________________

Amount to be: REFUNDED:____________________

or CREDITED TO 2007:___________________

11. Late filing penalty:_____________

Penalty:______________ Interest:____________ . . . . . . . . . . . . . . . .11. ____________________

12. BALANCE DUE

(Add line 9 and line 11) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .12. ____________________

DECLARATION OF ESTIMATED TAX DUE FOR TAX YEAR 2007

MANDATORY IF LIABILITY

$25.00 FAILURE TO FILE FEE IF NOT COMPLETED AND

IS $500.00 OR MORE

$75.00 FAILURE TO PAY ACCORDING TO PAY SCHEDULES

13. Total estimated tax due for tax year 2007 (Gross taxable income multiplied by 1.5%) . . . . . . . . . . . . . . . . . . . . .13. _____________________

14. Less credits (including prior year credit from line 10 and local taxes withheld) . . . . . . . . . . . . . . . . . . . . . . . . . . .14. _____________________

15. Net taxes owed for tax year 2007 estimated tax . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .15. _____________________

16. Amount paid with this declaration (1/4 of amount in box 15) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .16. _____________________

17. TOTAL DUE – ADD BOXES 12 and 16 to arrive at total due with this return . . . . . . . . . . . . . . . . . . . . . . . . . .17. _____________________

The undersigned declares that this return (and accompanying W-2’s, schedules and statements) is a true, correct and complete return for the taxable

period stated and that the figures used herein are the same as used for Federal Income Tax purposes. If this return was prepared by a tax

practitioner, may we contact your practitioner directly with questions regarding the preparation of this return? _____ Yes _____ No.

TO MAKE A CREDIT CARD OR ELECTRONIC

C

CHECK PAYMENT PLEASE CALL

Your Signature

DATE

1-866-549-1010 OR VISIT THE WEB-SITE AT

(A CONVENIENCE FEE OF 2.5% OF THE

CREDIT CARD PAYMENT AMOUNT AND/OR

Spouse’s Signature

DATE

A FLAT FEE OF $3.00 FOR EACH

ELECTRONIC CHECK WILL APPLY. FEES

MAY BE SUBJECT TO CHANGE).

Signature and telephone number of preparer (if other than taxpayer)

DATE

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1