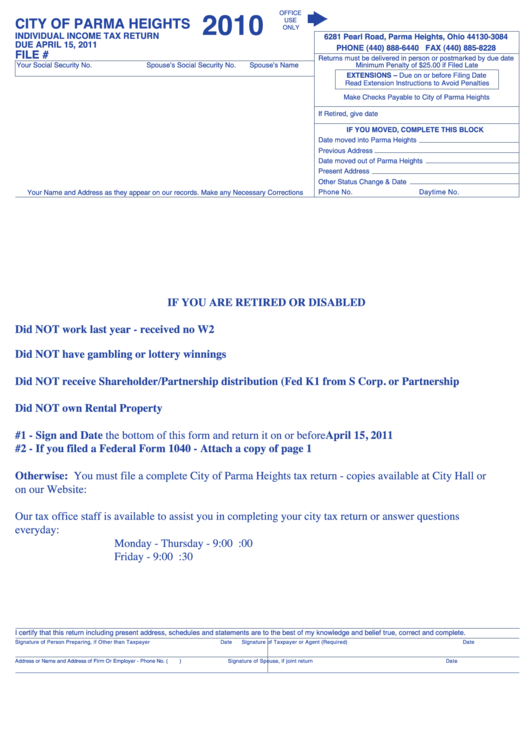

Individual Income Tax Return - City Of Parma Heights - 2010

ADVERTISEMENT

OFFICE

2010

CITY OF PARMA HEIGHTS

USE

ONLY

INDIVIDUAL INCOME TAX RETURN

6281 Pearl Road, Parma Heights, Ohio 44130-3084

DUE APRIL 15, 2011

PHONE (440) 888-6440 FAX (440) 885-8228

FILE #

Returns must be delivered in person or postmarked by due date

Your Social Security No.

Spouse’s Social Security No.

Spouse’s Name

Minimum Penalty of $25.00 if Filed Late

EXTENSIONS – Due on or before Filing Date

Read Extension Instructions to Avoid Penalties

Make Checks Payable to City of Parma Heights

If Retired, give date

IF YOU MOVED, COMPLETE THIS BLOCK

Date moved into Parma Heights

Previous Address

Date moved out of Parma Heights

Present Address

Other Status Change & Date

Phone No.

Daytime No.

Your Name and Address as they appear on our records. Make any Necessary Corrections

IF YOU ARE RETIRED OR DISABLED

Did NOT work last year - received no W2

Did NOT have gambling or lottery winnings

Did NOT receive Shareholder/Partnership distribution (Fed K1 from S Corp. or Partnership

Did NOT own Rental Property

#1 - Sign and Date the bottom of this form and return it on or before April 15, 2011

#2 - If you filed a Federal Form 1040 - Attach a copy of page 1

Otherwise: You must file a complete City of Parma Heights tax return - copies available at City Hall or

on our Website:

Our tax office staff is available to assist you in completing your city tax return or answer questions

everyday:

Monday - Thursday - 9:00 A.M. to 4:00 P.M.

Friday - 9:00 A.M. to 3:30 P.M.

I certify that this return including present address, schedules and statements are to the best of my knowledge and belief true, correct and complete.

Signature of Person Preparing, if Other than Taxpayer

Date

Signature of Taxpayer or Agent (Required)

Date

Address or Name and Address of Firm Or Employer - Phone No. (

)

Signature of Spouse, if joint return

Date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1