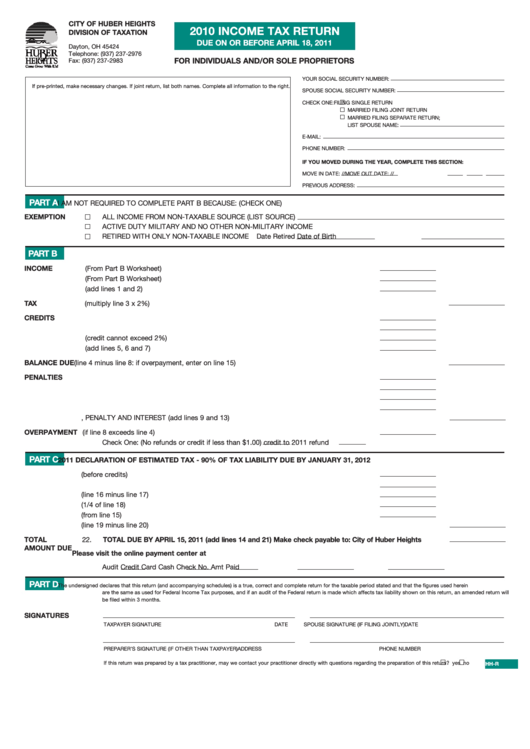

2010 Income Tax Return - City Of Huber Heights Division Of Taxation

ADVERTISEMENT

CITY OF HUBER HEIGHTS

2010 INCOME TAX RETURN

DIVISION OF TAXATION

P.O. Box 24309

DUE ON OR BEFORE APRIL 18, 2011

Dayton, OH 45424

Telephone: (937) 237-2976

FOR INDIVIDUALS AND/OR SOLE PROPRIETORS

Fax: (937) 237-2983

YOUR SOCIAL SECURITY NUMBER:

If pre-printed, make necessary changes. If joint return, list both names. Complete all information to the right.

SPOUSE SOCIAL SECURITY NUMBER:

CHECK ONE:

FILING SINGLE RETURN

MARRIED FILING JOINT RETURN

MARRIED FILING SEPARATE RETURN;

LIST SPOUSE NAME:

E-MAIL:

PHONE NUMBER:

IF YOU MOVED DURING THE YEAR, COMPLETE THIS SECTION:

MOVE IN DATE:

/

/

MOVE OUT DATE:

/

/

PREVIOUS ADDRESS:

PART A

I AM NOT REQUIRED TO COMPLETE PART B BECAUSE: (CHECK ONE)

EXEMPTION

ALL INCOME FROM NON-TAXABLE SOURCE (LIST SOURCE)

ACTIVE DUTY MILITARY AND NO OTHER NON-MILITARY INCOME

RETIRED WITH ONLY NON-TAXABLE INCOME

Date Retired

Date of Birth

PART B

INCOME

1.

TOTAL TAXABLE WAGES (From Part B Worksheet) .......................................................... 1

2.

TOTAL OTHER INCOME (From Part B Worksheet) ............................................................ 2

3.

TOTAL TAXABLE INCOME (add lines 1 and 2)................................................................... 3

TAX

4.

HUBER HEIGHTS CITY TAX (multiply line 3 x 2%) ................................................................................................ 4

CREDITS

5.

ESTIMATED PAYMENTS / PRIOR YEAR CREDITS............................................................ 5

6.

HUBER HEIGHTS TAX WITHHELD..................................................................................... 6

7.

OTHER CITY TAX WITHHELD (credit cannot exceed 2%) ................................................ 7

8.

TOTAL PAYMENTS AND CREDITS (add lines 5, 6 and 7).................................................. 8

BALANCE DUE

9.

BALANCE OF TAX DUE (line 4 minus line 8: if overpayment, enter on line 15)..................................................... 9

PENALTIES

10.

PENALTY ............................................................................................................................10

11.

UNDER-PAYMENT OF ESTIMATE PENALTY.....................................................................11

12.

INTEREST ...........................................................................................................................12

13.

TOTAL PENALTY AND INTEREST......................................................................................13

14.

TOTAL TAX, PENALTY AND INTEREST (add lines 9 and 13) .................................................................................14

OVERPAYMENT 15.

OVERPAYMENT (if line 8 exceeds line 4)...........................................................................15

Check One: (No refunds or credit if less than $1.00)

credit to 2011

refund

PART C

2011 DECLARATION OF ESTIMATED TAX - 90% OF TAX LIABILITY DUE BY JANUARY 31, 2012

16.

TOTAL 2011 ESTIMATED TAX (before credits) ..................................................................16

17.

LESS CREDIT FOR TAX WITHHELD..................................................................................17

18.

NET 2011 ESTIMATED TAX DUE (line 16 minus line 17) ...................................................18

19.

QUARTERLY AMOUNT DUE (1/4 of line 18)......................................................................19

20.

OVERPAYMENT CREDIT (from line 15)..............................................................................20

21.

BALANCE OF FIRST QTR PAYMENT (line 19 minus line 20).................................................................................21

TOTAL

22.

TOTAL DUE BY APRIL 15, 2011 (add lines 14 and 21) Make check payable to: City of Huber Heights ..........22

AMOUNT DUE

Please visit the online payment center at to pay by credit card or electronic check.

Audit

Credit Card

Cash

Check No.

Amt Paid

PART D

The undersigned declares that this return (and accompanying schedules) is a true, correct and complete return for the taxable period stated and that the figures used herein

are the same as used for Federal Income Tax purposes, and if an audit of the Federal return is made which affects tax liability shown on this return, an amended return will

be filed within 3 months.

SIGNATURES

TAXPAYER SIGNATURE

DATE

SPOUSE SIGNATURE (IF FILING JOINTLY)

DATE

PREPARER’S SIGNATURE (IF OTHER THAN TAXPAYER)

ADDRESS

PHONE NUMBER

If this return was prepared by a tax practitioner, may we contact your practitioner directly with questions regarding the preparation of this return?

yes

no

Form: HH-R

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2