Print and Reset Form

Reset Form

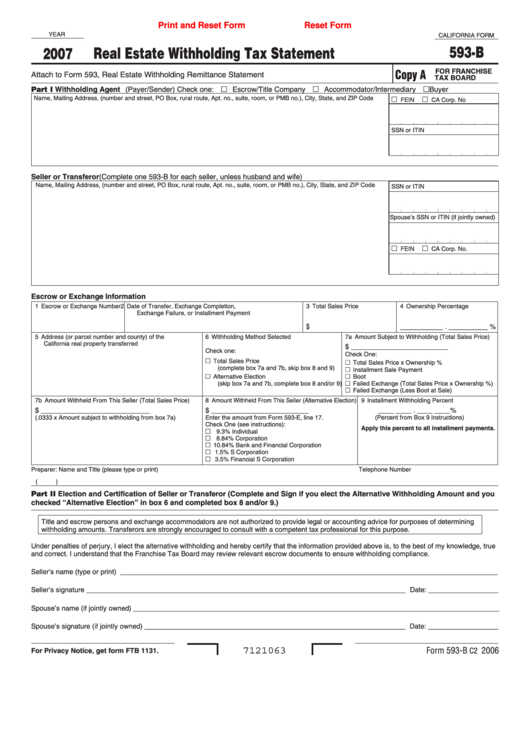

YEAR

CALIFORNIA FORM

593-B

2007

Real Estate Withholding Tax Statement

Copy A

FOR FRANCHISE

Attach to Form 593, Real Estate Withholding Remittance Statement

TAX BOARD

Part I Withholding Agent (Payer/Sender) Check one: Escrow/Title Company Accommodator/Intermediary Buyer

Name, Mailing Address, (number and street, PO Box, rural route, Apt. no., suite, room, or PMB no.), City, State, and ZIP Code

FEIN

CA Corp. No

SSN or ITIN

Seller or Transferor (Complete one 593-B for each seller, unless husband and wife)

Name, Mailing Address, (number and street, PO Box, rural route, Apt. no., suite, room, or PMB no.), City, State, and ZIP Code

SSN or ITIN

Spouse’s SSN or ITIN (if jointly owned)

FEIN

CA Corp. No.

Escrow or Exchange Information

1 Escrow or Exchange Number

2 Date of Transfer, Exchange Completion,

3 Total Sales Price

4 Ownership Percentage

Exchange Failure, or Installment Payment

$

___________ . __________ %

5 Address (or parcel number and county) of the

6 Withholding Method Selected

7a Amount Subject to Withholding (Total Sales Price)

California real property transferred

$ _________________________

Check one:

Check One:

Total Sales Price

Total Sales Price x Ownership %

(complete box 7a and 7b, skip box 8 and 9)

Installment Sale Payment

Alternative Election

Boot

(skip box 7a and 7b, complete box 8 and/or 9)

Failed Exchange (Total Sales Price x Ownership %)

Failed Exchange (Less Boot at Sale)

7b Amount Withheld From This Seller (Total Sales Price)

8 Amount Withheld From This Seller (Alternative Election)

9 Installment Withholding Percent

$ ____________________________

$ _________________________

____ ____ . ____ ____%

(.0333 x Amount subject to withholding from box 7a)

Enter the amount from Form 593-E, line 17.

(Percent from Box 9 instructions)

Check One (see instructions):

Apply this percent to all installment payments.

9.3% Individual

8.84% Corporation

10.84% Bank and Financial Corporation

1.5% S Corporation

3.5% Financial S Corporation

Preparer: Name and Title (please type or print)

Telephone Number

( )

Part II Election and Certification of Seller or Transferor (Complete and Sign if you elect the Alternative Withholding Amount and you

checked “Alternative Election” in box 6 and completed box 8 and/or 9.)

Title and escrow persons and exchange accommodators are not authorized to provide legal or accounting advice for purposes of determining

withholding amounts. Transferors are strongly encouraged to consult with a competent tax professional for this purpose.

Under penalties of perjury, I elect the alternative withholding and hereby certify that the information provided above is, to the best of my knowledge, true

and correct. I understand that the Franchise Tax Board may review relevant escrow documents to ensure withholding compliance.

Seller’s name (type or print) _________________________________________________________________________________________________

Seller’s signature __________________________________________________________________________________ Date: __________________

Spouse’s name (if jointly owned) ______________________________________________________________________________________________

Spouse’s signature (if jointly owned) ___________________________________________________________________ Date: __________________

7121063

Form 593-B

2006

C2

For Privacy Notice, get form FTB 1131.

1

1 2

2 3

3 4

4