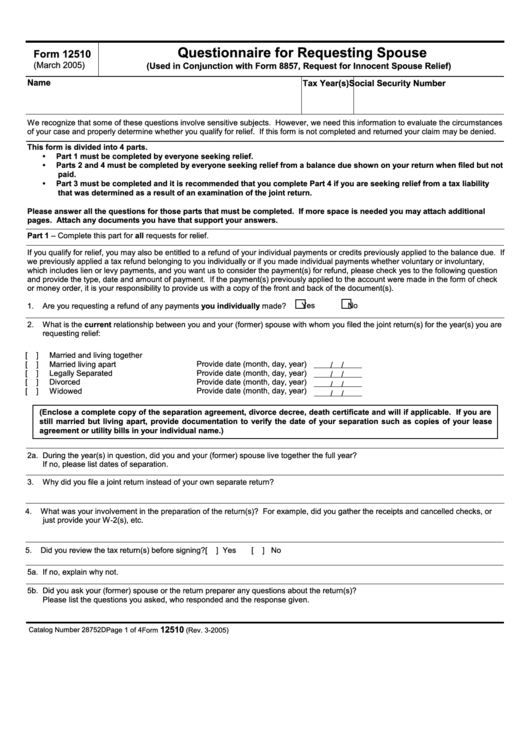

Questionnaire for Requesting Spouse

Form 12510

(March 2005)

(Used in Conjunction with Form 8857, Request for Innocent Spouse Relief)

Name

Tax Year(s) Social Security Number

We recognize that some of these questions involve sensitive subjects. However, we need this information to evaluate the circumstances

of your case and properly determine whether you qualify for relief. If this form is not completed and returned your claim may be denied.

This form is divided into 4 parts.

•

Part 1 must be completed by everyone seeking relief.

•

Parts 2 and 4 must be completed by everyone seeking relief from a balance due shown on your return when filed but not

paid.

•

Part 3 must be completed and it is recommended that you complete Part 4 if you are seeking relief from a tax liability

that was determined as a result of an examination of the joint return.

Please answer all the questions for those parts that must be completed. If more space is needed you may attach additional

pages. Attach any documents you have that support your answers.

Part 1 – Complete this part for all requests for relief.

If you qualify for relief, you may also be entitled to a refund of your individual payments or credits previously applied to the balance due. If

we previously applied a tax refund belonging to you individually or if you made individual payments whether voluntary or involuntary,

which includes lien or levy payments, and you want us to consider the payment(s) for refund, please check yes to the following question

and provide the type, date and amount of payment. If the payment(s) previously applied to the account were made in the form of check

or money order, it is your responsibility to provide us with a copy of the front and back of the document(s).

Yes

No

1.

Are you requesting a refund of any payments you individually made?

2.

What is the current relationship between you and your (former) spouse with whom you filed the joint return(s) for the year(s) you are

requesting relief:

[

]

Married and living together

[

]

Married living apart

Provide date (month, day, year)

/

/

Provide date (month, day, year)

[

]

Legally Separated

/

/

[

]

Divorced

Provide date (month, day, year)

/

/

Provide date (month, day, year)

[

]

Widowed

/

/

(Enclose a complete copy of the separation agreement, divorce decree, death certificate and will if applicable. If you are

still married but living apart, provide documentation to verify the date of your separation such as copies of your lease

agreement or utility bills in your individual name.)

2a. During the year(s) in question, did you and your (former) spouse live together the full year?

If no, please list dates of separation.

3.

Why did you file a joint return instead of your own separate return?

4.

What was your involvement in the preparation of the return(s)? For example, did you gather the receipts and cancelled checks, or

just provide your W-2(s), etc.

5.

Did you review the tax return(s) before signing?

[

] Yes

[

] No

5a. If no, explain why not.

5b. Did you ask your (former) spouse or the return preparer any questions about the return(s)?

Please list the questions you asked, who responded and the response given.

12510

Catalog Number 28752D

Page 1 of 4

Form

(Rev. 3-2005)

1

1 2

2 3

3 4

4