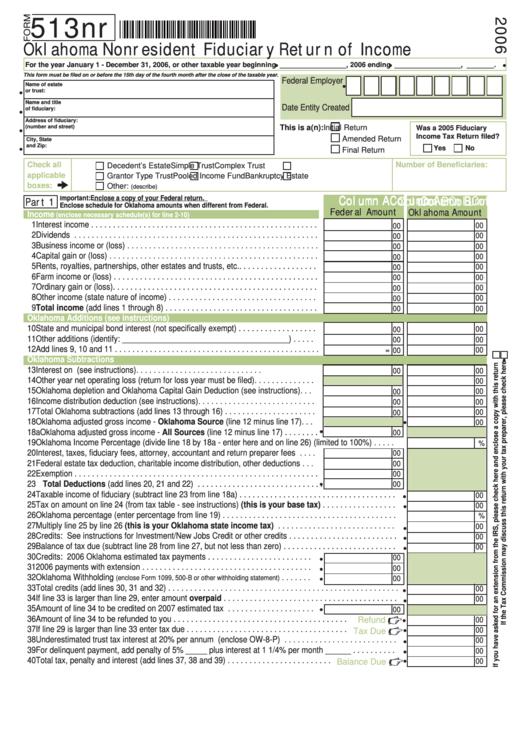

513nr

Oklahoma Nonresident Fiduciary Return of Income

•

•

•

For the year January 1 - December 31, 2006, or other taxable year beginning _________________, 2006 ending _________________, _______.

This form must be filed on or before the 15th day of the fourth month after the close of the taxable year.

Federal Employer

•

Name of estate

I.D. Number

•

or trust:

Name and title

Date Entity Created

of fiduciary:

•

Address of fiduciary:

This is a(n):

Initial Return

(number and street)

Was a 2005 Fiduciary

•

Income Tax Return filed?

Amended Return

City, State

and Zip:

•

Yes

No

Final Return

Check all

Number of Beneficiaries:

Decedent’s Estate

Simple Trust

Complex Trust

applicable

Grantor Type Trust

Pooled Income Fund

Bankruptcy Estate

boxes:

Other:

(describe)

mportant: Enclose a copy of your Federal return.

I

Column A

Column A

Column A

Column A

Column A

Column B

Column B

Column B

Column B

Column B

Part 1

Enclose schedule for Oklahoma amounts when different from Federal.

Federal Amount

Oklahoma Amount

Income

(enclose necessary schedule(s) for line 2-10)

1 Interest income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

00

00

2 Dividends . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

00

00

3 Business income or (loss) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

00

00

4 Capital gain or (loss) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

00

00

5 Rents, royalties, partnerships, other estates and trusts, etc.. . . . . . . . . . . . . . . . . .

00

00

6 Farm income or (loss) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

00

00

7 Ordinary gain or (loss). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

00

00

8 Other income (state nature of income) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

00

00

9 Total income (add lines 1 through 8) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

00

00

Oklahoma Additions (see instructions)

10 State and municipal bond interest (not specifically exempt) . . . . . . . . . . . . . . . . . .

00

00

11 Other additions (identify: _______________________________________) . . . . .

00

00

12 Add lines 9, 10 and 11 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

00

00

=

Oklahoma Subtractions

13 Interest on U.S. obligations (see instructions). . . . . . . . . . . . . . . . . . . . . . . . . . . . .

00

00

14 Other year net operating loss (return for loss year must be filed). . . . . . . . . . . . . .

00

15 Oklahoma depletion and Oklahoma Capital Gain Deduction (see instructions). . .

00

00

16 Income distribution deduction (see instructions). . . . . . . . . . . . . . . . . . . . . . . . . . .

00

00

17 Total Oklahoma subtractions (add lines 13 through 16) . . . . . . . . . . . . . . . . . . . . .

00

00

18 Oklahoma adjusted gross income - Oklahoma Source (line 12 minus line 17). . .

•

00

•

18a Oklahoma adjusted gross income - All Sources (line 12 minus line 17) . . . . . . . .

00

19 Oklahoma Income Percentage (divide line 18 by 18a - enter here and on line 26) (limited to 100%) . . . . .

%

20 Interest, taxes, fiduciary fees, attorney, accountant and return preparer fees . . . .

00

21 Federal estate tax deduction, charitable income distribution, other deductions . . .

00

22 Exemption . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

00

•

23 Total Deductions (add lines 20, 21 and 22) . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

00

24 Taxable income of fiduciary (subtract line 23 from line 18a) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

•

00

25 Tax on amount on line 24 (from tax table - see instructions) (this is your base tax) . . . . . . . . . . . . . . . . .

•

00

26 Oklahoma percentage (enter percentage from line 19) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

%

27 Multiply line 25 by line 26 (this is your Oklahoma state income tax) . . . . . . . . . . . . . . . . . . . . . . . . . . .

00

•

28 Credits: See instructions for Investment/New Jobs Credit or other credits . . . . . . . . . . . . . . . . . . . . . . . . .

•

00

29 Balance of tax due (subtract line 28 from line 27, but not less than zero) . . . . . . . . . . . . . . . . . . . . . . . . . .

•

00

30 Credits: 2006 Oklahoma estimated tax payments . . . . . . . . . . . . . . . . . . . . . . . .

•

00

31 2006 payments with extension . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

•

00

32 Oklahoma Withholding

. . . . . . .

•

(enclose Form 1099, 500-B or other withholding statement)

00

33 Total credits (add lines 30, 31 and 32) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

00

•

34 If line 33 is larger than line 29, enter amount overpaid . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

00

•

•

35 Amount of line 34 to be credited on 2007 estimated tax . . . . . . . . . . . . . . . . . . . .

00

36 Amount of line 34 to be refunded to you . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

•

Refund

00

37 If line 29 is larger than line 33 enter tax due . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

•

00

Tax Due

38 Underestimated trust tax interest at 20% per annum (enclose OW-8-P) . . . . . . . . . . . . . . . . . . . . . . . . . .

•

00

39 For delinquent payment, add penalty of 5% _____ plus interest at 1 1/4% per month ______ . . . . . . . . . .

•

00

•

40 Total tax, penalty and interest (add lines 37, 38 and 39) . . . . . . . . . . . . . . . . . . . . . . . .

Balance Due

00

1

1 2

2