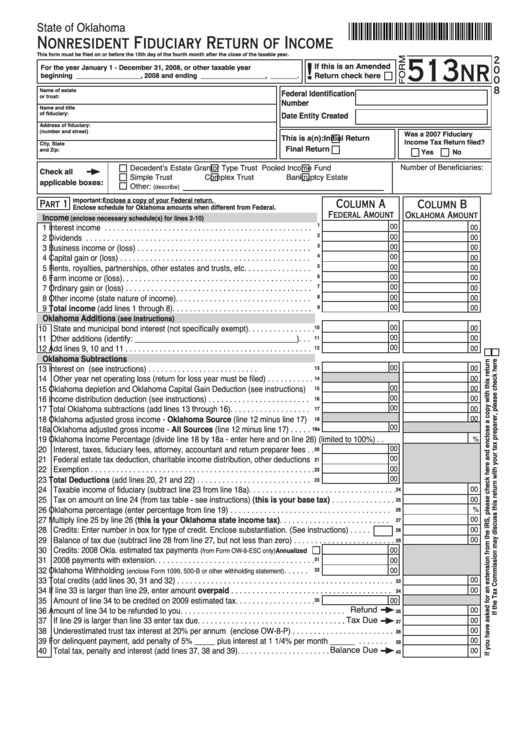

State of Oklahoma

Nonresident Fiduciary Return of Income

This form must be filed on or before the 15th day of the fourth month after the close of the taxable year.

513

2

nr

!

If this is an Amended

For the year January 1 - December 31, 2008, or other taxable year

0

Return check here

beginning _________________, 2008 and ending _________________, _______.

0

8

Name of estate

Federal Identification

or trust:

Number

Name and title

of fiduciary:

Date Entity Created

Address of fiduciary:

(number and street)

Was a 2007 Fiduciary

This is a(n):

Initial Return

Income Tax Return filed?

City, State

Final Return

and Zip:

Yes

No

Number of Beneficiaries:

Decedent’s Estate

Grantor Type Trust

Pooled Income Fund

Check all

Simple Trust

Complex Trust

Bankruptcy Estate

applicable boxes:

Other:

(describe)

mportant: Enclose a copy of your Federal return.

I

Column A

Column B

Part 1

Enclose schedule for Oklahoma amounts when different from Federal.

Federal Amount

Oklahoma Amount

Income

(enclose necessary schedule(s) for lines 2-10)

1

00

1 Interest income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

00

2

00

2 Dividends . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

00

00

3 Business income or (loss) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

00

4 Capital gain or (loss) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

00

4

00

00

5 Rents, royalties, partnerships, other estates and trusts, etc. . . . . . . . . . . . . . . .

5

00

00

6 Farm income or (loss). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

00

6

00

7 Ordinary gain or (loss) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

00

7

00

8 Other income (state nature of income). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

00

8

00

9 Total income (add lines 1 through 8). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

00

9

Oklahoma Additions

(see instructions)

00

10 State and municipal bond interest (not specifically exempt). . . . . . . . . . . . . . . .

00

10

00

11 Other additions (identify: _______________________________________). . .

00

11

00

12 Add lines 9, 10 and 11 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

00

12

Oklahoma Subtractions

00

13 Interest on U.S. obligations (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . .

00

13

14 Other year net operating loss (return for loss year must be filed) . . . . . . . . . . .

00

14

00

15 Oklahoma depletion and Oklahoma Capital Gain Deduction (see instructions)

00

15

00

16 Income distribution deduction (see instructions) . . . . . . . . . . . . . . . . . . . . . . . .

00

16

00

17 Total Oklahoma subtractions (add lines 13 through 16). . . . . . . . . . . . . . . . . . .

00

17

18 Oklahoma adjusted gross income - Oklahoma Source (line 12 minus line 17)

00

18

00

18a Oklahoma adjusted gross income - All Sources (line 12 minus line 17) . . . . .

18a

19 Oklahoma Income Percentage (divide line 18 by 18a - enter here and on line 26) (limited to 100%) . .

%

20 Interest, taxes, fiduciary fees, attorney, accountant and return preparer fees . .

00

20

21 Federal estate tax deduction, charitable income distribution, other deductions

00

21

00

22 Exemption . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

22

00

23 Total Deductions (add lines 20, 21 and 22) . . . . . . . . . . . . . . . . . . . . . . . . . . .

23

24 Taxable income of fiduciary (subtract line 23 from line 18a). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

00

24

25 Tax on amount on line 24 (from tax table - see instructions) (this is your base tax) . . . . . . . . . . . . . . .

00

25

26 Oklahoma percentage (enter percentage from line 19) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

%

26

27 Multiply line 25 by line 26 (this is your Oklahoma state income tax). . . . . . . . . . . . . . . . . . . . . . . . . .

00

27

28 Credits: Enter number in box for type of credit. Enclose substantiation. (See instructions) . . . . .

00

28

29 Balance of tax due (subtract line 28 from line 27, but not less than zero) . . . . . . . . . . . . . . . . . . . . . . . .

00

29

30 Credits: 2008 Okla. estimated tax payments

00

(from Form OW-8-ESC only) Annualized

31 2008 payments with extension. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

00

31

32 Oklahoma Withholding

. . . . . .

00

32

(enclose Form 1099, 500-B or other withholding statement)

33 Total credits (add lines 30, 31 and 32) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

00

33

34 If line 33 is larger than line 29, enter amount overpaid . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

00

34

35 Amount of line 34 to be credited on 2009 estimated tax. . . . . . . . . . . . . . . . . . .

00

35

Refund

36 Amount of line 34 to be refunded to you. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

00

36

Tax Due

37 If line 29 is larger than line 33 enter tax due. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

00

37

38 Underestimated trust tax interest at 20% per annum (enclose OW-8-P) . . . . . . . . . . . . . . . . . . . . . . . .

00

38

39 For delinquent payment, add penalty of 5% _____ plus interest at 1 1/4% per month ______ . . . . . . .

00

39

Balance Due

40 Total tax, penalty and interest (add lines 37, 38 and 39). . . . . . . . . . . . . . . . . . . . . .

00

40

1

1 2

2