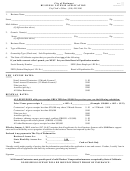

Business License Application Fee Worksheet

ADVERTISEMENT

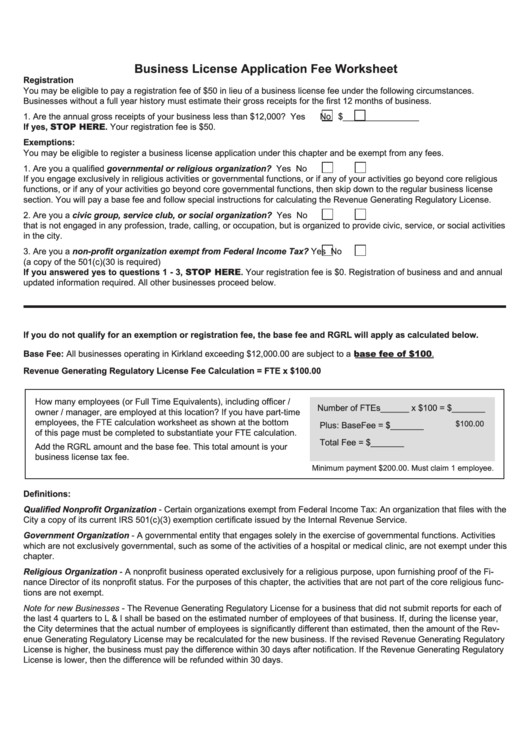

Business License Application Fee Worksheet

Registration

You may be eligible to pay a registration fee of $50 in lieu of a business license fee under the following circumstances.

Businesses without a full year history must estimate their gross receipts for the first 12 months of business.

1. Are the annual gross receipts of your business less than $12,000?

Yes

No $________________

If yes, STOP HERE. Your registration fee is $50.

Exemptions:

You may be eligible to register a business license application under this chapter and be exempt from any fees.

1. Are you a qualified governmental or religious organization?

Yes

No

If you engage exclusively in religious activities or governmental functions, or if any of your activities go beyond core religious

functions, or if any of your activities go beyond core governmental functions, then skip down to the regular business license

section. You will pay a base fee and follow special instructions for calculating the Revenue Generating Regulatory License.

2. Are you a civic group, service club, or social organization?

Yes

No

that is not engaged in any profession, trade, calling, or occupation, but is organized to provide civic, service, or social activities

in the city.

3. Are you a non-profit organization exempt from Federal Income Tax?

Yes

No

(a copy of the 501(c)(30 is required)

If you answered yes to questions 1 - 3, STOP HERE. Your registration fee is $0. Registration of business and and annual

updated information required. All other businesses proceed below.

If you do not qualify for an exemption or registration fee, the base fee and RGRL will apply as calculated below.

Base Fee: All businesses operating in Kirkland exceeding $12,000.00 are subject to a base fee of $100.

Revenue Generating Regulatory License Fee Calculation = FTE x $100.00

How many employees (or Full Time Equivalents), including officer /

Number of FTEs______ x $100 = $_______

owner / manager, are employed at this location? If you have part-time

employees, the FTE calculation worksheet as shown at the bottom

$100.00

Plus: BaseFee = $_______

of this page must be completed to substantiate your FTE calculation.

Total Fee = $_______

Add the RGRL amount and the base fee. This total amount is your

business license tax fee.

Minimum payment $200.00. Must claim 1 employee.

Definitions:

Qualified Nonprofit Organization - Certain organizations exempt from Federal Income Tax: An organization that files with the

City a copy of its current IRS 501(c)(3) exemption certificate issued by the Internal Revenue Service.

Government Organization - A governmental entity that engages solely in the exercise of governmental functions. Activities

which are not exclusively governmental, such as some of the activities of a hospital or medical clinic, are not exempt under this

chapter.

Religious Organization - A nonprofit business operated exclusively for a religious purpose, upon furnishing proof of the Fi-

nance Director of its nonprofit status. For the purposes of this chapter, the activities that are not part of the core religious func-

tions are not exempt.

Note for new Businesses - The Revenue Generating Regulatory License for a business that did not submit reports for each of

the last 4 quarters to L & I shall be based on the estimated number of employees of that business. If, during the license year,

the City determines that the actual number of employees is significantly different than estimated, then the amount of the Rev-

enue Generating Regulatory License may be recalculated for the new business. If the revised Revenue Generating Regulatory

License is higher, the business must pay the difference within 30 days after notification. If the Revenue Generating Regulatory

License is lower, then the difference will be refunded within 30 days.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2