How long will it take to process my documents?

Regular processing time for submitted documents

is about 7-8 weeks; Expedited processing request will be responded to within 7 business days.

Documents hand-delivered in limited quantities receive same day service between 8:30 am and 4:30

pm.

Hand-delivered transactions are to be paid by check

only. There is an expedited fee for same day

service for document processing.

The expedited service fee is an additional $50.00 for this document; other fees may also apply. Check

the Fee Schedule web page for a list of all service fees,

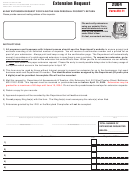

Mail completed forms to: State Department of Assessments and Taxation, Charter Division, 301 W.

Preston Street; 8th Floor, Baltimore, MD 21201-2395. Fax completed forms with Mastercard or Visa

credit card payment information to 410-333-7097. Fax request will be charged the additional expedited

service fee.

NOTE: Due to the fact that the laws governing the formation and operation of business entities and

the effectiveness of a UCC Financing Statement involves more than filing documents with our office,

we suggest you consult an attorney, accountant or other professional. State Department of

Assessments & Taxation staff can not offer business counseling or legal advice.

Notice regarding annual documents to be filed with the Department of Assessments & Taxation:

All

domestic and foreign legal entities must submit a Personal Property Return to the Department. Failure to

file a Personal Property Return will result in forfeiture of your right to conduct business in Maryland.

Copies of the return are available on the SDAT website.

The returns are due April 15th of each year.

SDAT: Corporate Charter

1

1 2

2 3

3 4

4