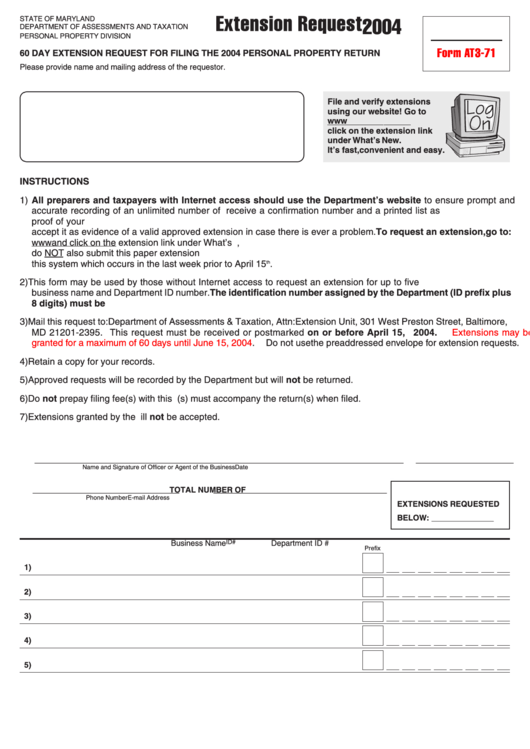

STATE OF MARYLAND

Extension Request

2004

DEPARTMENT OF ASSESSMENTS AND TAXATION

PERSONAL PROPERTY DIVISION

Form AT3-71

60 DAY EXTENSION REQUEST FOR FILING THE 2004 PERSONAL PROPERTY RETURN

Please provide name and mailing address of the requestor.

File and verify extensions

using our website! Go to

and

click on the extension link

under What’s New.

It’s fast, convenient and easy.

INSTRUCTIONS

1) All preparers and taxpayers with Internet access should use the Department’s website to ensure prompt and

accurate recording of an unlimited number of requests. You will receive a confirmation number and a printed list as

proof of your submission. Always print and keep a copy of the confirmation page. The Department will automatically

accept it as evidence of a valid approved extension in case there is ever a problem. To request an extension, go to:

and click on the extension link under What’s New. When you file for an extension via our website,

do NOT also submit this paper extension request. Please file early to avoid possible delays due to the heavy usage of

this system which occurs in the last week prior to April 15

th

.

2) This form may be used by those without Internet access to request an extension for up to five businesses. List exact

business name and Department ID number. The identification number assigned by the Department (ID prefix plus

8 digits) must be provided. Incomplete IDs will not be recorded.

3) Mail this request to: Department of Assessments & Taxation, Attn: Extension Unit, 301 West Preston Street, Baltimore,

MD 21201-2395. This request must be received or postmarked on or before April 15, 2004.

Extensions may be

granted for a maximum of 60 days until June 15,

2004. Do not use the preaddressed envelope for extension requests.

4) Retain a copy for your records.

5) Approved requests will be recorded by the Department but will not be returned.

6) Do not prepay filing fee(s) with this form. The filing fee(s) must accompany the return(s) when filed.

7) Extensions granted by the I.R.S. or the Maryland Comptroller will not be accepted.

___________________________________________________________________________________

______________________

Name and Signature of Officer or Agent of the Business

Date

_________________________________

_______________________________________

TOTAL NUMBER OF

Phone Number

E-mail Address

EXTENSIONS REQUESTED

BELOW: ______________

ID#

Business Name

Department ID #

Prefix

1)

2)

3)

4)

5)

1

1