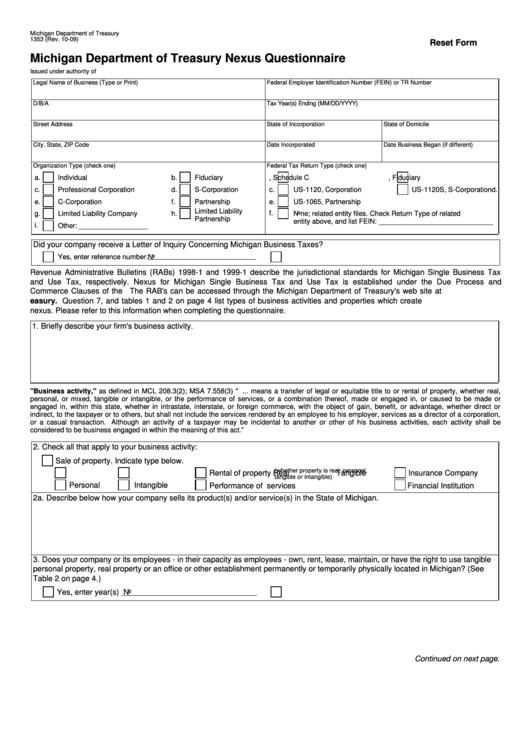

Michigan Department of Treasury

1353 (Rev. 10-09)

Reset Form

Michigan Department of Treasury Nexus Questionnaire

Issued under authority of P.A. 228 of 1975.

Legal Name of Business (Type or Print)

Federal Employer Identification Number (FEIN) or TR Number

D/B/A

Tax Year(s) Ending (MM/DD/YYYY)

Street Address

State of Incorporation

State of Domicile

City, State, ZIP Code

Date Incorporated

Date Business Began (if different)

Organization Type (check one)

Federal Tax Return Type (check one)

a.

Individual

b.

Fiduciary

a.

US-1040, Schedule C

b.

US-1041, Fiduciary

c.

Professional Corporation

d.

S-Corporation

c.

US-1120, Corporation

d.

US-1120S, S-Corporation

e.

C-Corporation

f.

Partnership

e.

US-1065, Partnership

Limited Liability

f.

g.

Limited Liability Company

h.

None; related entity files. Check Return Type of related

Partnership

entity above, and list FEIN:

i.

Other:

Did your company receive a Letter of Inquiry Concerning Michigan Business Taxes?

Yes, enter reference number:

No

Revenue Administrative Bulletins (RABs) 1998-1 and 1999-1 describe the jurisdictional standards for Michigan Single Business Tax

and Use Tax, respectively. Nexus for Michigan Single Business Tax and Use Tax is established under the Due Process and

Commerce Clauses of the U.S. Constitution. The RAB's can be accessed through the Michigan Department of Treasury's web site at

Question 7, and tables 1 and 2 on page 4 list types of business activities and properties which create

nexus. Please refer to this information when completing the questionnaire.

1. Briefly describe your firm's business activity.

"Business activity," as defined in MCL 208.3(2); MSA 7.558(3) " ... means a transfer of legal or equitable title to or rental of property, whether real,

personal, or mixed, tangible or intangible, or the performance of services, or a combination thereof, made or engaged in, or caused to be made or

engaged in, within this state, whether in intrastate, interstate, or foreign commerce, with the object of gain, benefit, or advantage, whether direct or

indirect, to the taxpayer or to others, but shall not include the services rendered by an employee to his employer, services as a director of a corporation,

or a casual transaction. Although an activity of a taxpayer may be incidental to another or other of his business activities, each activity shall be

considered to be business engaged in within the meaning of this act.”

2. Check all that apply to your business activity:

Sale of property. Indicate type below.

(whether property is real, personal,

Real

Tangible

Rental of property

Insurance Company

tangible or intangible)

Personal

Intangible

Performance of services

Financial Institution

2a. Describe below how your company sells its product(s) and/or service(s) in the State of Michigan.

3. Does your company or its employees - in their capacity as employees - own, rent, lease, maintain, or have the right to use tangible

personal property, real property or an office or other establishment permanently or temporarily physically located in Michigan? (See

Table 2 on page 4.)

Yes, enter year(s)

No

Continued on next page.

1

1 2

2 3

3