Form Mf 47 - Schedule E Physical Inventory Of Tobacco Products In Michigan - Michigan Department Of Treasury, Michigan

ADVERTISEMENT

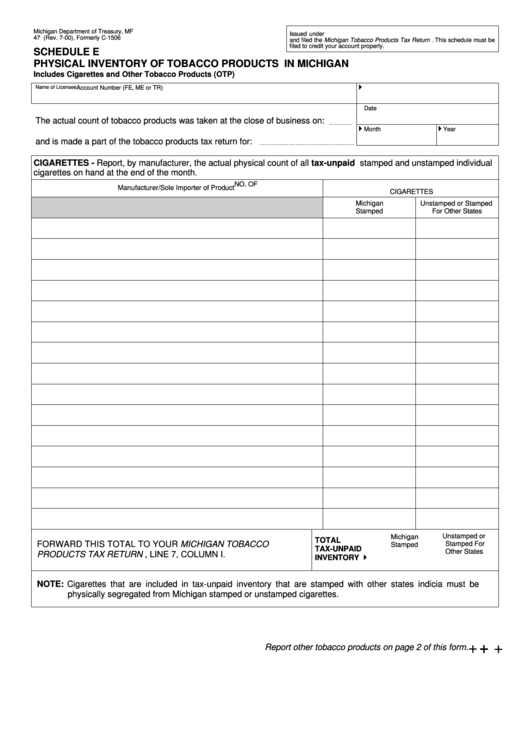

Michigan Department of Treasury, MF

Issued under P.A. 327 of 1993. Filing is mandatory if you are a wholesaler

47 (Rev. 7-00), Formerly C-1506

and filed the Michigan Tobacco Products Tax Return . This schedule must be

filed to credit your account properly.

SCHEDULE E

PHYSICAL INVENTORY OF TOBACCO PRODUCTS IN MICHIGAN

Includes Cigarettes and Other Tobacco Products (OTP)

Name of Licensee

Account Number (FE, ME or TR)

Date

The actual count of tobacco products was taken at the close of business on:

Month

Year

and is made a part of the tobacco products tax return for:

CIGARETTES - Report, by manufacturer, the actual physical count of all tax-unpaid stamped and unstamped individual

cigarettes on hand at the end of the month.

NO. OF

Manufacturer/Sole Importer of Product

CIGARETTES

Michigan

Unstamped or Stamped

Stamped

For Other States

Unstamped or

Michigan

TOTAL

FORWARD THIS TOTAL TO YOUR MICHIGAN TOBACCO

Stamped For

Stamped

TAX-UNPAID

Other States

PRODUCTS TAX RETURN , LINE 7, COLUMN I.

INVENTORY

NOTE: Cigarettes that are included in tax-unpaid inventory that are stamped with other states indicia must be

physically segregated from Michigan stamped or unstamped cigarettes.

+ + + +

Report other tobacco products on page 2 of this form.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2