Form 104pn - Part-Year Resident/nonresident Tax Calculation Schedule - 2001

ADVERTISEMENT

-

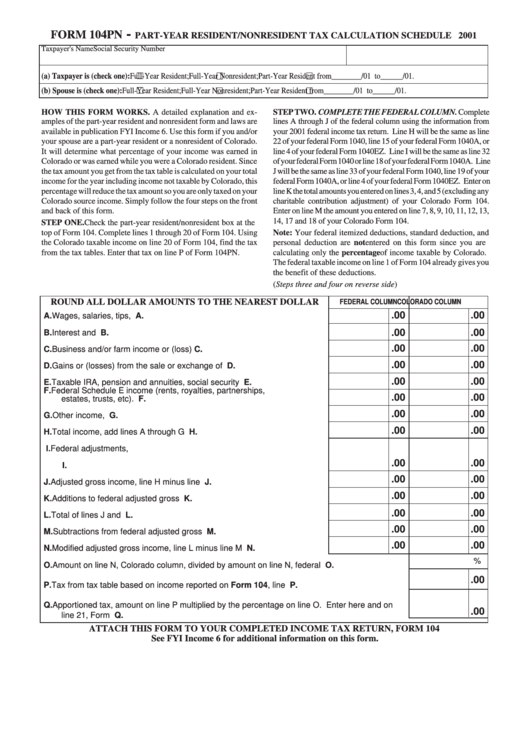

FORM 104PN

PART-YEAR RESIDENT/NONRESIDENT TAX CALCULATION SCHEDULE 2001

Taxpayer's Name

Social Security Number

(a) Taxpayer is (check one):

Full-Year Resident;

Full-Year Nonresident;

Part-Year Resident from ________ /01 to ______ /01.

(b) Spouse is (check one):

Full-Year Resident;

Full-Year Nonresident;

Part-Year Resident from ________ /01 to ______ /01.

HOW THIS FORM WORKS. A detailed explanation and ex-

STEP TWO. COMPLETE THE FEDERAL COLUMN. Complete

amples of the part-year resident and nonresident form and laws are

lines A through J of the federal column using the information from

available in publication FYI Income 6. Use this form if you and/or

your 2001 federal income tax return. Line H will be the same as line

your spouse are a part-year resident or a nonresident of Colorado.

22 of your federal Form 1040, line 15 of your federal Form 1040A, or

It will determine what percentage of your income was earned in

line 4 of your federal Form 1040EZ. Line I will be the same as line 32

Colorado or was earned while you were a Colorado resident. Since

of your federal Form 1040 or line 18 of your federal Form 1040A. Line

the tax amount you get from the tax table is calculated on your total

J will be the same as line 33 of your federal Form 1040, line 19 of your

income for the year including income not taxable by Colorado, this

federal Form 1040A, or line 4 of your federal Form 1040EZ. Enter on

percentage will reduce the tax amount so you are only taxed on your

line K the total amounts you entered on lines 3, 4, and 5 (excluding any

Colorado source income. Simply follow the four steps on the front

charitable contribution adjustment) of your Colorado Form 104.

and back of this form.

Enter on line M the amount you entered on line 7, 8, 9, 10, 11, 12, 13,

14, 17 and 18 of your Colorado Form 104.

STEP ONE. Check the part-year resident/nonresident box at the

top of Form 104. Complete lines 1 through 20 of Form 104. Using

Note: Your federal itemized deductions, standard deduction, and

the Colorado taxable income on line 20 of Form 104, find the tax

personal deduction are not entered on this form since you are

from the tax tables. Enter that tax on line P of Form 104PN.

calculating only the percentage of income taxable by Colorado.

The federal taxable income on line 1 of Form 104 already gives you

the benefit of these deductions.

(Steps three and four on reverse side)

ROUND ALL DOLLAR AMOUNTS TO THE NEAREST DOLLAR

FEDERAL COLUMN

COLORADO COLUMN

.00

.00

A.

Wages, salaries, tips, etc. ................................................................. A.

.00

.00

B.

Interest and dividends ....................................................................... B.

.00

.00

C.

Business and/or farm income or (loss) .............................................. C.

.00

.00

D.

Gains or (losses) from the sale or exchange of assets ..................... D.

.00

.00

E.

Taxable IRA, pension and annuities, social security .......................... E.

F.

Federal Schedule E income (rents, royalties, partnerships,

.00

.00

estates, trusts, etc). ............................................................................ F.

.00

.00

G.

Other income, list .............................................................................. G.

.00

.00

H.

Total income, add lines A through G ................................................. H.

I.

Federal adjustments, list .......................................................................

.00

.00

............................................................................................................. I.

.00

.00

J.

Adjusted gross income, line H minus line I ......................................... J.

.00

.00

K.

Additions to federal adjusted gross income ....................................... K.

.00

.00

L.

Total of lines J and K .......................................................................... L.

.00

.00

M. Subtractions from federal adjusted gross income ............................. M.

.00

.00

N.

Modified adjusted gross income, line L minus line M ........................ N.

%

O.

Amount on line N, Colorado column, divided by amount on line N, federal column ............... O.

.00

P.

Tax from tax table based on income reported on Form 104, line 20 ..................................... P.

Q.

Apportioned tax, amount on line P multiplied by the percentage on line O. Enter here and on

.00

line 21, Form 104 ................................................................................................................... Q.

ATTACH THIS FORM TO YOUR COMPLETED INCOME TAX RETURN, FORM 104

See FYI Income 6 for additional information on this form.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4