City Of Salem Tax Return Form

ADVERTISEMENT

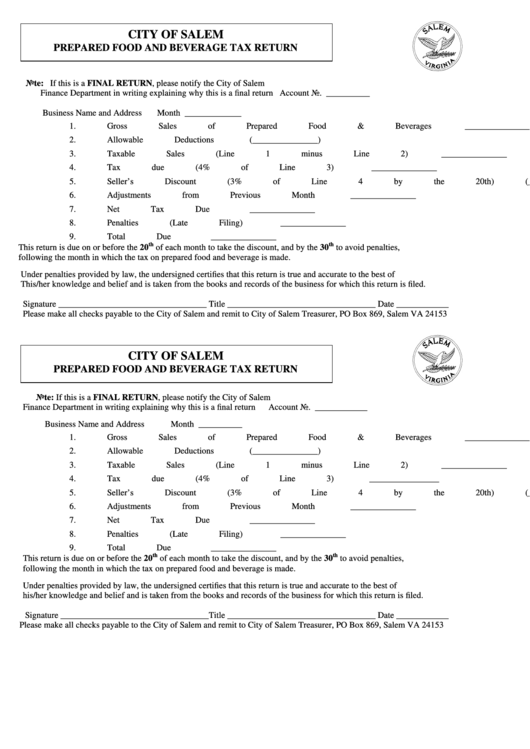

CITY OF SALEM

PREPARED FOOD AND BEVERAGE TAX RETURN

Note:

If this is a FINAL RETURN, please notify the City of Salem

Finance Department in writing explaining why this is a final return

Account No. __________

Business Name and Address

Month _____________

1.

Gross Sales of Prepared Food & Beverages _______________

2.

Allowable Deductions

(_______________)

3.

Taxable Sales (Line 1 minus Line 2)

_______________

4.

Tax due (4% of Line 3)

_______________

5.

Seller’s Discount (3% of Line 4 by the 20th) (_______________)

6.

Adjustments from Previous Month

_______________

7.

Net Tax Due

_______________

8.

Penalties (Late Filing)

_______________

9.

Total Due

_______________

th

th

This return is due on or before the 20

of each month to take the discount, and by the 30

to avoid penalties,

following the month in which the tax on prepared food and beverage is made.

Under penalties provided by law, the undersigned certifies that this return is true and accurate to the best of

This/her knowledge and belief and is taken from the books and records of the business for which this return is filed.

Signature __________________________________ Title __________________________________ Date ____________

Please make all checks payable to the City of Salem and remit to City of Salem Treasurer, PO Box 869, Salem VA 24153

CITY OF SALEM

PREPARED FOOD AND BEVERAGE TAX RETURN

Note:

If this is a FINAL RETURN, please notify the City of Salem

Finance Department in writing explaining why this is a final return

Account No. ____________

Business Name and Address

Month __________

1.

Gross Sales of Prepared Food & Beverages _______________

2.

Allowable Deductions

(_______________)

3.

Taxable Sales (Line 1 minus Line 2)

_______________

4.

Tax due (4% of Line 3)

________________

5.

Seller’s Discount (3% of Line 4 by the 20th) (_______________)

6.

Adjustments from Previous Month

_______________

7.

Net Tax Due

_______________

8.

Penalties (Late Filing)

_______________

9.

Total Due

_______________

th

th

This return is due on or before the 20

of each month to take the discount, and by the 30

to avoid penalties,

following the month in which the tax on prepared food and beverage is made.

Under penalties provided by law, the undersigned certifies that this return is true and accurate to the best of

his/her knowledge and belief and is taken from the books and records of the business for which this return is filed.

Signature __________________________________Title __________________________________ Date ____________

Please make all checks payable to the City of Salem and remit to City of Salem Treasurer, PO Box 869, Salem VA 24153

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1