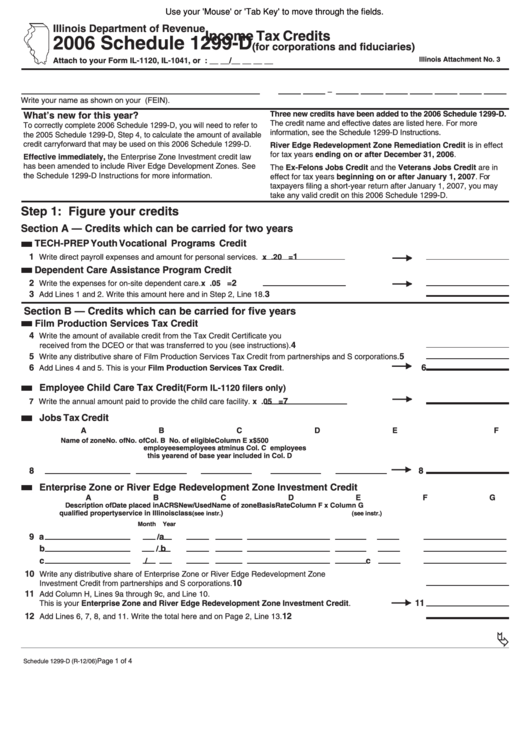

Use your 'Mouse' or 'Tab Key' to move through the fields.

Illinois Department of Revenue

Income Tax Credits

2006 Schedule 1299-D

(for corporations and fiduciaries)

Illinois Attachment No. 3

Attach to your Form IL-1120, IL-1041, or IL-990-T.

Tax Year Ending: __ __/__ __ __ __

–

Write your name as shown on your return.

Write your federal employer identification number (FEIN).

Three new credits have been added to the 2006 Schedule 1299-D.

What’s new for this year?

The credit name and effective dates are listed here. For more

To correctly complete 2006 Schedule 1299-D, you will need to refer to

information, see the Schedule 1299-D Instructions.

the 2005 Schedule 1299-D, Step 4, to calculate the amount of available

credit carryforward that may be used on this 2006 Schedule 1299-D.

River Edge Redevelopment Zone Remediation Credit is in effect

for tax years ending on or after December 31, 2006.

Effective immediately, the Enterprise Zone Investment credit law

has been amended to include River Edge Development Zones. See

The Ex-Felons Jobs Credit and the Veterans Jobs Credit are in

the Schedule 1299-D Instructions for more information.

effect for tax years beginning on or after January 1, 2007. For

taxpayers filing a short-year return after January 1, 2007, you may

take any valid credit on this 2006 Schedule 1299-D.

Step 1: Figure your credits

Section A — Credits which can be carried for two years

TECH-PREP Youth Vocational Programs Credit

1

1

Write direct payroll expenses and amount for personal services.

x .20 =

Dependent Care Assistance Program Credit

2

2

Write the expenses for on-site dependent care.

x .05 =

3

3

Add Lines 1 and 2. Write this amount here and in Step 2, Line 18.

Section B — Credits which can be carried for five years

Film Production Services Tax Credit

4

Write the amount of available credit from the Tax Credit Certificate you

4

received from the DCEO or that was transferred to you (see instructions).

5

5

Write any distributive share of Film Production Services Tax Credit from partnerships and S corporations.

6

6

Add Lines 4 and 5. This is your Film Production Services Tax Credit.

Employee Child Care Tax Credit

(Form IL-1120 filers only)

7

7 Write the annual amount paid to provide the child care facility.

x .05 =

Jobs Tax Credit

A

B

C

D

E

F

Name of zone

No. of

No. of

Col. B

No. of eligible

Column E x $500

employees

employees at

minus Col. C

employees

this year

end of base year

included in Col. D

8

8

Enterprise Zone or River Edge Redevelopment Zone Investment Credit

A

B

C

D

E

F

G

H

Description of

Date placed in

ACRS New/Used

Name of zone

Basis

Rate

Column F x Column G

qualified property

service in Illinois class

)

(see instr.

(see instr.)

Month Year

9 a

a

/

b

b

/

c

c

/

10

Write any distributive share of Enterprise Zone or River Edge Redevelopment Zone

10

Investment Credit from partnerships and S corporations.

11

Add Column H, Lines 9a through 9c, and Line 10.

11

This is your Enterprise Zone and River Edge Redevelopment Zone Investment Credit.

12

12

Add Lines 6, 7, 8, and 11. Write the total here and on Page 2, Line 13.

Page 1 of 4

Schedule 1299-D (R-12/06)

1

1 2

2 3

3 4

4