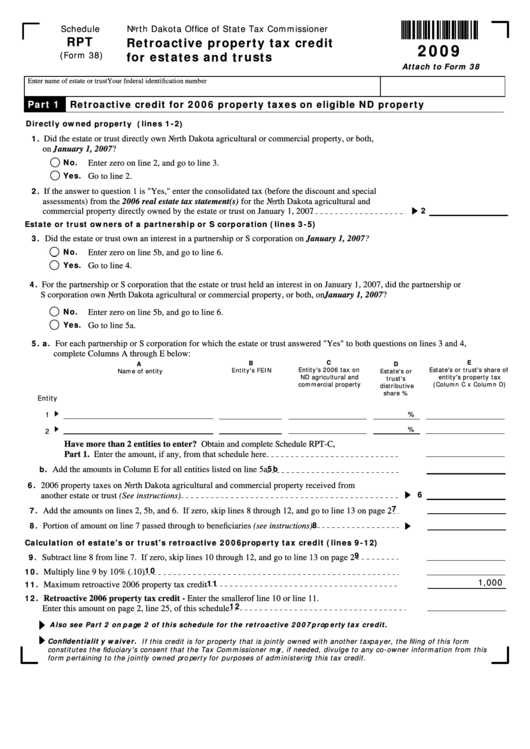

Schedule

North Dakota Office of State Tax Commissioner

RPT

Retroactive property tax credit

2009

for estates and trusts

(Form 38)

Attach to Form 38

Enter name of estate or trust

Your federal identification number

Part 1

Retroactive credit for 2006 property taxes on eligible ND property

Directly owned property (lines 1-2)

1.

Did the estate or trust directly own North Dakota agricultural or commercial property, or both,

on January 1, 2007 ?

No.

Enter zero on line 2, and go to line 3.

Yes.

Go to line 2.

2.

If the answer to question 1 is "Yes," enter the consolidated tax (before the discount and special

assessments) from the 2006 real estate tax statement(s) for the North Dakota agricultural and

2

commercial property directly owned by the estate or trust on January 1, 2007

Estate or trust owners of a partnership or S corporation (lines 3-5)

3.

Did the estate or trust own an interest in a partnership or S corporation on January 1, 2007 ?

No.

Enter zero on line 5b, and go to line 6.

Yes.

Go to line 4.

4.

For the partnership or S corporation that the estate or trust held an interest in on January 1, 2007, did the partnership or

S corporation own North Dakota agricultural or commercial property, or both, on January 1, 2007 ?

No.

Enter zero on line 5b, and go to line 6.

Yes.

Go to line 5a.

5. a.

For each partnership or S corporation for which the estate or trust answered "Yes" to both questions on lines 3 and 4,

complete Columns A through E below:

C

E

B

A

D

Entity's 2006 tax on

Estate's or trust's share of

Entity's FEIN

Name of entity

Estate's or

ND agricultural and

entity's property tax

trust's

commercial property

(Column C x Column D)

distributive

share %

Entity

%

1

%

2

Have more than 2 entities to enter? Obtain and complete Schedule RPT-C,

Part 1. Enter the amount, if any, from that schedule here

b.

5b

Add the amounts in Column E for all entities listed on line 5a

6.

2006 property taxes on North Dakota agricultural and commercial property received from

6

another estate or trust (See instructions)

7

7.

Add the amounts on lines 2, 5b, and 6. If zero, skip lines 8 through 12, and go to line 13 on page 2

8.

8

Portion of amount on line 7 passed through to beneficiaries (see instructions)

Calculation of estate's or trust's retroactive 2006 property tax credit (lines 9-12)

9

9.

Subtract line 8 from line 7. If zero, skip lines 10 through 12, and go to line 13 on page 2

10

10.

Multiply line 9 by 10% (.10)

1,000

11

11.

Maximum retroactive 2006 property tax credit

12.

Retroactive 2006 property tax credit - Enter the smaller of line 10 or line 11.

12

Enter this amount on page 2, line 25, of this schedule

Also see Part 2 on page 2 of this schedule for the retroactive 2007 property tax credit.

Confidentiality waiver. If this credit is for property that is jointly owned with another taxpayer, the filing of this form

constitutes the fiduciary's consent that the Tax Commissioner may, if needed, divulge to any co-owner information from this

form pertaining to the jointly owned property for purposes of administering this tax credit.

1

1 2

2