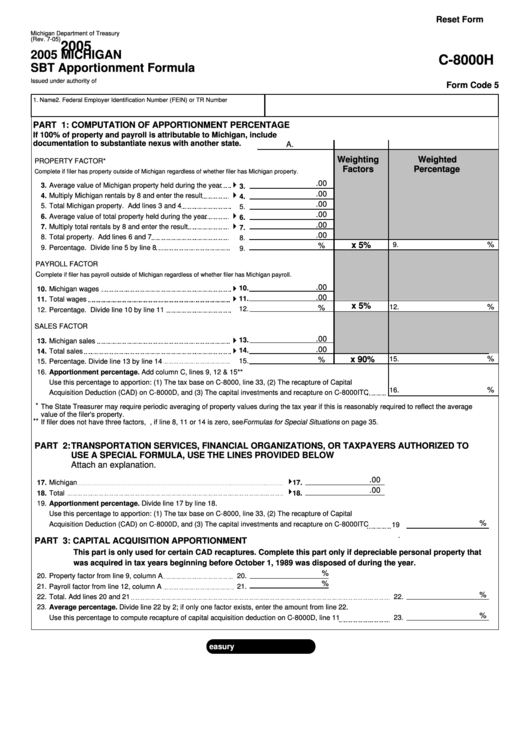

Reset Form

Michigan Department of Treasury

(Rev. 7-05)

2005

2005 MICHIGAN

C-8000H

SBT Apportionment Formula

Issued under authority of P.A. 228 of 1975. See instruction booklet for filing guidelines.

Form Code 5

1. Name

2. Federal Employer Identification Number (FEIN) or TR Number

PART 1: COMPUTATION OF APPORTIONMENT PERCENTAGE

If 100% of property and payroll is attributable to Michigan, include

documentation to substantiate nexus with another state.

A.

B.

C.

Weighting

Weighted

PROPERTY FACTOR*

Factors

Percentage

Complete if filer has property outside of Michigan regardless of whether filer has Michigan property.

.00

3.

Average value of Michigan property held during the year

3.

.00

4.

Multiply Michigan rentals by 8 and enter the result

4.

.00

5.

Total Michigan property. Add lines 3 and 4

5.

.00

6.

Average value of total property held during the year

6.

.00

7.

Multiply total rentals by 8 and enter the result

7.

.00

8.

Total property. Add lines 6 and 7

8.

%

x 5%

9.

%

9.

Percentage. Divide line 5 by line 8

9.

PAYROLL FACTOR

C

omplete if filer has payroll outside of Michigan regardless of whether filer has Michigan payroll.

.00

10.

10.

Michigan wages

.00

11.

11.

Total wages

x 5%

%

12.

%

12.

12.

Percentage. Divide line 10 by line 11

SALES FACTOR

.00

13.

13.

Michigan sales

.00

14.

14.

Total sales

%

x 90%

15.

%

15.

15.

Percentage. Divide line 13 by line 14

16.

Apportionment percentage. Add column C, lines 9, 12 & 15**

Use this percentage to apportion: (1) The tax base on C-8000, line 33, (2) The recapture of Capital

%

16.

Acquisition Deduction (CAD) on C-8000D, and (3) The capital investments and recapture on C-8000ITC

*

The State Treasurer may require periodic averaging of property values during the tax year if this is reasonably required to reflect the average

value of the filer's property.

**

If filer does not have three factors, i.e., if line 8, 11 or 14 is zero, see Formulas for Special Situations on page 35.

PART 2:

TRANSPORTATION SERVICES, FINANCIAL ORGANIZATIONS, OR TAXPAYERS AUTHORIZED TO

USE A SPECIAL FORMULA, USE THE LINES PROVIDED BELOW

Attach an explanation.

.00

17.

Michigan

17.

.00

18.

Total

18.

19.

Apportionment percentage. Divide line 17 by line 18.

Use this percentage to apportion: (1) The tax base on C-8000, line 33, (2) The recapture of Capital

%

Acquisition Deduction (CAD) on C-8000D, and (3) The capital investments and recapture on C-8000ITC

19

.

PART 3: CAPITAL ACQUISITION APPORTIONMENT

This part is only used for certain CAD recaptures. Complete this part only if depreciable personal property that

was acquired in tax years beginning before October 1, 1989 was disposed of during the year.

%

20.

Property factor from line 9, column A

20.

%

21.

Payroll factor from line 12, column A

21.

%

22.

Total. Add lines 20 and 21

22.

23.

Average percentage. Divide line 22 by 2; if only one factor exists, enter the amount from line 22.

%

Use this percentage to compute recapture of capital acquisition deduction on C-8000D, line 11

23.

1

1